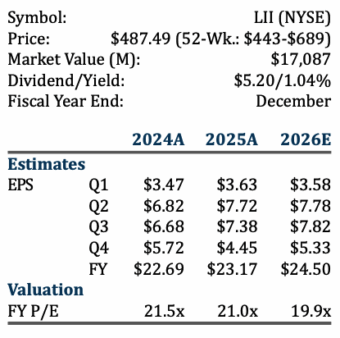

A recent William Blair report breaks down the quarter and what comes next. The headline numbers looked rough. Lennox missed Q4 on weaker new residential construction and heavier destocking than expected, and shares dropped 2%. Then management guided 2026 below what the Street was looking for. But context matters here. Lennox has historically been a company that hits its numbers, which made the string of 2025 misses notable. Now the question is whether this guidance represents a genuine reset, with a management team that finally has a handle on where demand actually sits, or whether they are still catching up.

Signs the HVAC Market Bottom Is Forming

Lennox is guiding residential volumes down mid-single digits for 2026. That sounds weak until you remember it comes on top of already-depressed 2025 comps. William Blair calls this a low bar on easy comparisons, and Lennox itself said the worst is behind them, with headwinds turning to tailwinds as the year progresses.

The destocking story is central to this. Both one-step and two-step distribution channels are still working through excess inventory, and Q1 2026 will take another hit from both. But the data suggests contractor inventory levels are nearly normalized. Trailing shipments compared to warranty registrations show the one-step overhang should clear soon. That matters because once contractors and distributors stop working down stock and return to buying at normal rates, order patterns stabilize. Lennox is calling Q1 the bottom.

Commercial Carries Weight

Residential is still working through headwinds, but commercial tells a different story. Lennox expects Q1 commercial revenue up around 20%, helped by easy comps, acquisitions, and positive mix. Margins should expand as productivity initiatives and better factory absorption take hold.

For anyone balancing residential and commercial exposure, this divergence is worth paying attention to. Residential may be finding a floor, but commercial is already showing strength. Together they create a more stable picture than residential alone would suggest.

Pricing Holds, Replacement Demand Stays Uncertain

Lennox expects pricing to add mid-single digits to revenue for the full year, with carryover price helping the first half and list price realization kicking in later. Management sounded confident that industry pricing will hold.

The bigger unknown is repair versus replace. Consumer affordability is still challenged, and rising equipment costs paired with elevated interest rates make replacement a harder decision for homeowners. Lennox pointed to higher electricity prices and rising repair costs as factors that could push more homeowners toward replacement, but nobody knows yet whether that shift will materialize in 2026.

What This Means for the Channel

When a major OEM guides residential volumes down mid-single digits on soft comps, calls Q1 the low point, and expects improvement from there, that looks like a company trying to set a bar it can clear after a year of stumbles. Bulls say the guidance is genuinely conservative. Bears wonder if management has really recalibrated. Time will tell.

For distributors, contractors, and reps, the practical read is this: the conditions for stabilization are coming together. Destocking is clearing. Pricing is holding. Commercial provides support. Uncertainty around consumer demand and repair-versus-replace is real, but the worst of the inventory correction looks to be behind us.

The question shifts from how bad it gets to how you position for the turn. Planning for a recovery, even a modest one, looks different than bracing for more deterioration. Lennox’s low bar suggests we are closer to the former.

If this aligns with what you are seeing in your market, I would like to compare notes. CMG works with manufacturers, distributors, and rep firms who want clearer strategy, stronger channel performance, and better alignment across the field. If you are exploring ways to strengthen your commercial approach, reach out and let’s talk through what you are trying to build.

Leave a Reply Cancel reply