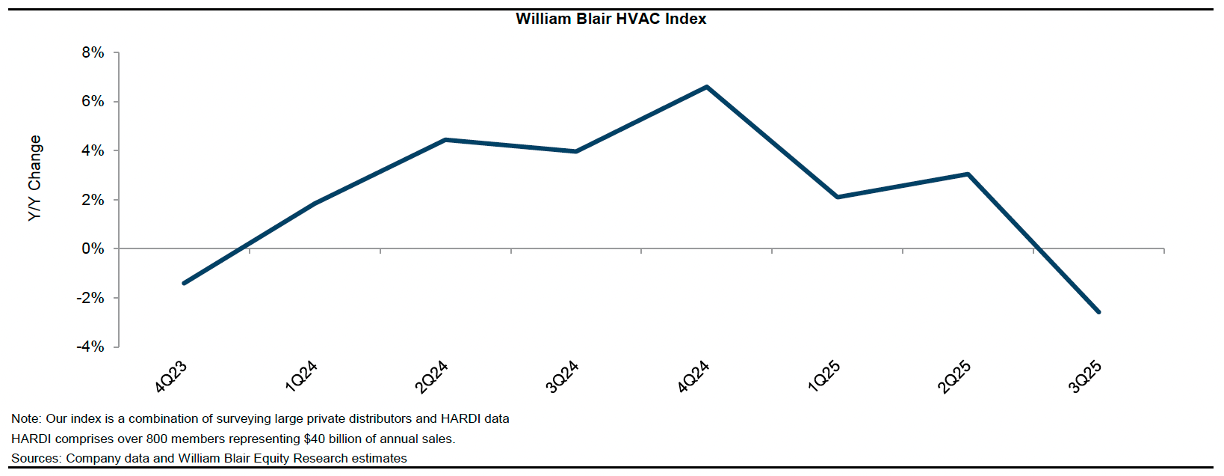

The third quarter of 2025 has been a rough ride for the HVAC industry. According to the William Blair’s 2025 HVAC Survey, distributors and manufacturers reported softening demand, persistent sticker shock, and an unusually cool summer—all combining to create what the firm called a “rough out there” environment. The William Blair HVAC Index fell 3% year over year, one of the weakest readings since the post-pandemic recovery, signaling that affordability and weather continue to drag on replacement activity.

The combination of elevated equipment prices, tougher financing conditions, and uncooperative weather has shifted the balance sharply toward repair over replacement. According to Blair’s analysts:

“Our mix has shifted to lower-end equipment. High-SEER equipment is down 20%.” — William Blair Equity Research

A Downbeat Quarter for the Channel

Distributors surveyed by William Blair painted a consistent picture: July started strong, but sales “fell off a cliff” in August before staging only a mild recovery in September. The culprits—stubbornly high prices tied to A2L refrigerant conversions, tariffs, and weak consumer confidence.

Price increases in the low-to-mid-teens have largely “stuck,” meaning consumers are still facing higher ticket prices even as overall demand erodes. Meanwhile, leftover R-410A inventory is being discounted aggressively, though little of it remains in the field.

Poor weather compounded the problem. Cooling degree days were down 4% nationally, with the Southeast—home to the industry’s most important replacement market—seeing an even sharper drop. When your busiest region has fewer hot days, demand for new systems takes a direct hit.

“July was decent, but August fell off a cliff. September recovered some, but not enough to offset August.” — William Blair HVAC Survey Respondent

Watsco Takes the Hit

Watsco (WSO) remains the industry bellwether, and William Blair’s analysts didn’t mince words. They downgraded the stock to Market Perform and cut third-quarter earnings estimates by 20%, from consensus $4.41 per share to $3.55.

Residential new construction was pegged down roughly 20%, and replacement sales off double digits—an unpleasant mix for the largest independent HVAC distributor in the U.S. The report warned that “visibility into an HVAC recovery may not improve until spring 2026,” and that shares could dip to around $300 if demand stays weak.

The firm expects Watsco’s fourth-quarter EPS to come in near $1.75 versus Street estimates of $2.46. Even with its long-term fundamentals intact, the near-term environment is too choppy for comfort.

For distributors across the country, the subtext is clear: conditions in the South remain the biggest swing factor, and those markets are struggling to find footing.

AAON Holds Its Ground

While Watsco retrenches, equipment manufacturer AAON (AAON) is emerging as the rare bright spot. ERP (enterprise resource planning) and production issues in its Oklahoma facility are improving, and gross margins are expected to rebound toward 30%.

Blair raised AAON’s third-quarter EPS estimate to $0.40—above the high end of guidance—on better operational execution and continuing strength in data center projects. The analysts believe the company’s long-term growth targets, including $1 billion in data-center revenue by 2027, remain realistic.

If rooftop unit margins can recover to the 35% range, Blair sees potential 2027 EPS of $3.50–$4.00, which could justify valuations north of $120 per share.

“Everything we heard indicates data center growth remains robust.” — William Blair Equity Research

Lennox: Soft Quarter, But Not a Crisis

Lennox International (LII) looks to have avoided the worst of the downturn, though Allied Air—its two-step distribution arm—is expected to take a sizable destocking hit. The firm expects Lennox’s Q3 EPS at $6.70, slightly below consensus $7.09.

While channel inventory remains high and new construction slow, Blair noted that investors have largely priced in the bad news. Commercial markets, particularly data centers and “megaprojects,” continue to offer some cushion, even as traditional segments lag.

Lennox still earns an Outperform rating based on longer-term tailwinds: new joint ventures, focus on cold-climate heat pumps, and steady margin improvement.

Broader Signals: Repair Wins, Construction Lags

Beyond individual companies, Blair’s survey found several trends shaping the next 12 months:

- Repair over replace is dominating. Consumers facing 10–15% price hikes are fixing older systems instead of buying new ones.

- New construction is stagnant. Homebuilders made midyear corrections to slow production. Multifamily projects are improving slightly off easy comparisons, but not enough to lift volumes.

- Commercial markets are split. Data centers and institutional megaprojects are still fueling growth, but traditional segments—schools, offices, retail—remain sluggish.

- Distributors expect a flat 2026. Most see mid-single-digit growth coming mainly from carryover pricing, not volume recovery.

Broader Signals: Repair Wins, Construction Lags

Beyond individual companies, Blair’s survey found several trends shaping the next 12 months:

- Repair over replace is dominating. Consumers facing 10–15% price hikes are fixing older systems instead of buying new ones.

- New construction is stagnant. Homebuilders made midyear corrections to slow production. Multifamily projects are improving slightly off easy comparisons, but not enough to lift volumes.

- Commercial markets are split. Data centers and institutional megaprojects are still fueling growth, but traditional segments—schools, offices, retail—remain sluggish.

- Distributors expect a flat 2026. Most see mid-single-digit growth coming mainly from carryover pricing, not volume recovery.

A2L Transition: Nearly Done, But Not Without Pain

The refrigerant transition to A2L systems—long cited as a source of cost inflation—is effectively complete, with only a few R-410A “stragglers” left in distributor warehouses. While that’s good for regulatory alignment, it has left many contractors and homeowners reeling from “sticker shock.”

Blair’s analysts noted that both consumers and dealers are balking at A2L-driven price increases, accelerating the shift toward repairs and prolonging the replacement slump.

Reading the Temperature of 2026

For now, the industry appears to be hunkering down. William Blair’s contacts among distributors and manufacturer reps are budgeting for “flattish” results next year. The next real test will be whether spring 2026 brings a rebound in replacement demand—or just another round of cautious inventory management.

Light commercial markets may already be bottoming, with rooftop unit sales stabilizing and DOAS (dedicated outdoor air systems) picking up modestly. Data centers remain the one consistently bright spot, and that niche could become the growth engine that carries select OEMs through the next cycle.

Still, the mood across the channel is unmistakably defensive. As one distributor summarized:

“We’re leaning into being independent and growing with the local guys.” — HVAC Distributor, William Blair Survey

What’s Next

If your sales team or branch managers are hearing the same story — slow replacement, sticker shock, and cautious demand — you’re not alone.

CMG’s Growth Planning System (GPS) and ChannelVision programs help distributors and reps identify where demand is actually shifting and how to adjust your playbook before 2026.

📩 Reach out to us at Channel Marketing Group or follow HVACRtrends for ongoing HVAC market intelligence.

Leave a Reply