Carrier’s Investor Day, May 19, 2025 provided a deep dive into the HVACR leading manufacturer strategy and results that were enlightening. Often in these high-level investor day presentations, you have to read between the lines.

As our HVACR trends are overwhelmingly based in North America, I concentrated on the presentation given by Gaurang Pandya – President – Climate Solutions Americas.

Gaurang started out with a quote that succinctly framed up the size and scope of Carrier in the Americas. “One in every three homes, or one in every three buildings” has a Carrier product installation.

I think of that installed base as a block of granite in terms of market share. The competition is trying to chip away at that granite block and Carrier is working to protect and expand it. Their Installed base and the protection of that core business is the foundation of Carriers strategy.

*Source: Carrier Investor Day May 19, 2025

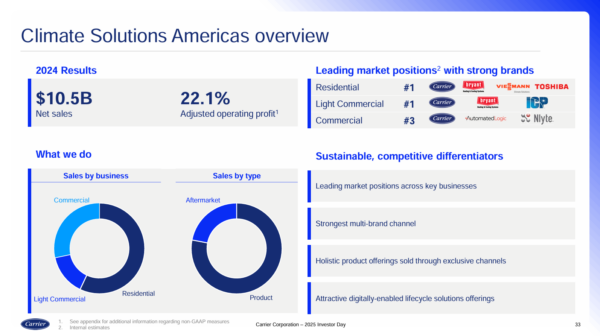

Carrier shared that of their total business “just over half is focused on the resi-end market and just under half on the commercial end markets.” said Gaurang Pandya. The market position provides the company a “significantly large installed base at 30 million units”.

*Source: Carrier Investor Day May 19, 2025

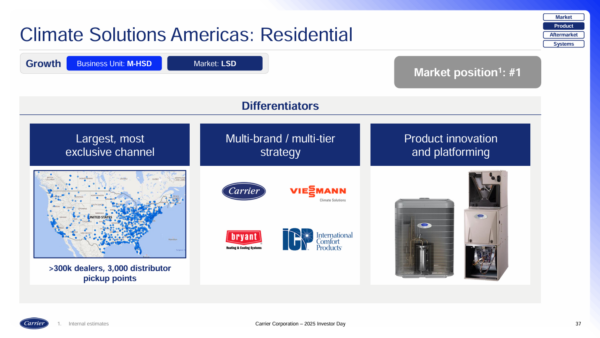

The backbone of the America’s Carrier experience is built on a foundation of distributors (3,000 Distributor locations) and more than 300,000 dealers. This one-two punch of Carrier Contractor dealers and a strong distribution network puts same day inventory right where the end customers need it.

As our son is in the HVACR business in Des Moines, I get to see firsthand that need for same day inventory. The number of new installs on existing homes and buildings and service calls to check on a system that is failing is an all day, everyday experience. He has some of his day planned most days (a new install at a home or light commercial) and then some days it is just responding to calls on failed or failing systems.

If need a part to fix a Carrier Unit on a service call (if it can be fixed) you will likely purchase a Carrier replacement part from the closest Carrier distributor to your location. Their network of dealers (end contractors) is extensive backed by an extensive distribution network to maintain their core Granite Block Business. *We have written extensively about WATSCO (Carriers Largest Distributor) with a full case study and companion podcast which you can see here.

Carrier doesn’t play just defense as they are aggressive with a multi-tier multi-brand strategy. They have products and solutions that serve all three tiers in the Good -Better – and Best Product and Price Categories. Is that approach working? Gaurang Pandya shared that “We have expanded share by three % (300 basis points) ” and that Carrier is the “Number 1 player by far”. Yes, it appears it is.

Carrier also shared that an area they are “doubling down is our digital ecosystem” and that they “have 40,000 technicians on the ground using our technician apps”.

One quote on this digital commitment really jumped out to me…

“We have above half a million systems that are connected where we’ve got real time Ai learning generation and data coming into our systems, that we are providing back to the field to be able to help our customers everyday.”

Gaurang Pandya – President – Climate Solutions Americas.

*Source: Carrier Investor Day May 19, 2025

I like the way Carrier Americas simply expressed their strategy in a four point approach. Digital ecosystem, vertical solutions, digital to increase aftermarket growth, and of course margin improvement.

Key Takeaways

I always like to think about Barriers to Exit for the customer and Barriers to Entry for the competition.

I view Carrier’s “Barriers to Exit” for customers and “Barriers to Entry” for the competition as:

- Large Installed Base – Their brand positions Carrier, Bryant, and more give them a strong good, better, best solution offering for Residential and Light Commercial. This is their block of granite market share position to defend and expand.

- A Focus on Aftermarket Sales to defend and protect this established installed base to get that repair business.

- Large Dealer Network – >300,000 Dealers in the Americas that they have programs and support for the repair and replace/new installation business.

- Digital Ecosystem – They have thru their distribution network and their own solutions an ever-growing number of field technicians using their apps and digital solutions to diagnose issues, find the right solution, and purchase a Carrier aftermarket solution or full replacement system.

- They are connecting their systems to get real time learning to make better business decisions and provide that data back to their distribution and dealer partners to help them improve their businesses.

It’s a simple plan to convey and understand as a business. When you have strong barriers to exit and entry you can devote more resources to share gain. Carrier is doing just that in the channel. Are you doing the same for your HVACR Channel business?

As always, we appreciate your comments and questions. jgunderson@channelmkt.com

Leave a Reply