In 2015 when I was on the HD Supply Power Solutions team, I started some research with the goal of getting feedback to make better pricing decisions with direct surveys for our associates. We were roughly a $2 billion dollar business trying to improve our GM% and profits. Over the past ten years that survey has grown in size and scope to include end customers, distributor associates, and manufacturers and has developed some interesting trendlines for the channel.

If you look at the economic forecasts it appears that 2025 will be a relatively flat to single digit growth market for HVACR. Historically when the market is slower growth the focus on “sell price” becomes one of the key drivers for end customers and your team.

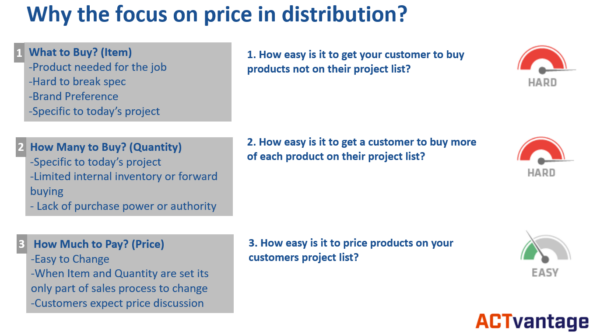

So, when business slows why is the focus on price so acute?

Source- 2015 -2024 Distributor Associate Survey Responses – John Gunderson

The focus on price for distribution has always been a key driver because it is difficult to get distributor end customers to:

- Buy additional products not on their project list

- Buy additional quantities of each product they need on their product list

When a customer reaches out for a specific part or list of parts for a new installation or repair getting them to buy more than what they need for that project is Hard. Your teams often try to cross sell and upsell, but it is difficult. The end-customers that the channel serves often have key constraints to upselling because of their warehouse space and project-based business.

For example – A Contractor is focused on buying just the precise amount of material they need to complete the job and even with discounting to buy more than they need for that project they are very reluctant to increase the quantity of the items on the order. Conversely, a contractor customer with service trucks often has limited space to store material and although they may be more open to buy more they are constrained by their space and the increased inventory carrying costs.

Cross selling – the McDonalds approach of “do you want fries with your order” is also difficult for the channel. The end customer is focused on only buying what they need for this order. The other factor that makes cross selling difficult is often the end customer may be buying those cross-sell items from another distributor and that makes it a more difficult sell.

The “human element” is also a big factor. Once you build a relationship with a customer and they make it clear that trying to cross sell and upsell them is not what they want you to do, you tend to give up on that approach quickly.

So, on each sales opportunity if you can’t generally upsell and cross sell the only other variable you can change is the “sell price”. For the balance of 2024 and into 2025 with slower business the focus on “sell price” has become more extreme.

Proven ways to grow top line sales and gross margin

Many distributor leaders feel that top line growth above market often requires gross margin declines. There is a core belief that if we push too high or don’t respond to the competition (who is always bombing the market level price) we will lose.

What is interesting in the past decade of this survey not a single distributor team has stated that their sell prices are similar or lower than the competition. Every team that has taken this survey over the past years has stated that their prices are higher than the competition (usually or always higher).

That belief that the competition has better pricing and is bombing the market is very common, and why when business gets competitive the reaction of most sales teams is to sharpen the pencil and go lower.

Price is important to winning business, but how to get paid for your value?

That is somewhat of a loaded question, but the solution I have seen work the most often in my time as a distributor pricing leader and getting to work with so many great distributor teams is as follows –

- Training your associates and building processes

If you do that there really isn’t a great need for a second step. You have talented people give them the training they need, help them build good processes, and good things generally follow.

As a HVACR Channel leader, I suggest you start with looking at the programs that HARDI offers (HARDI has a Pricing Certification program led by industry leaders from ACTvantage that is excellent HARDI (hardinet.org)). You might also consider looking at specific profit training programs put on by groups such as The Professional Pricing Association and many others.

The other easy thing to do is to make profit training a core part of your training curriculum. You have regular lunch and learns to deliver product training. Why not make sure you have 2-3 profit training lunch and learns for your associates in 2025? If fair price is truly important to winning orders why not train your team on how you want to manage the price process more effectively with regular training.

As always, we appreciate the feedback and comments. So, feel free to reach out at john.gunderson1217@gmail.com

Leave a Reply