This past month, I have been going through old boxes of work material and coming across some foundational material on customer segmentation and pricing that I used as a distributor.

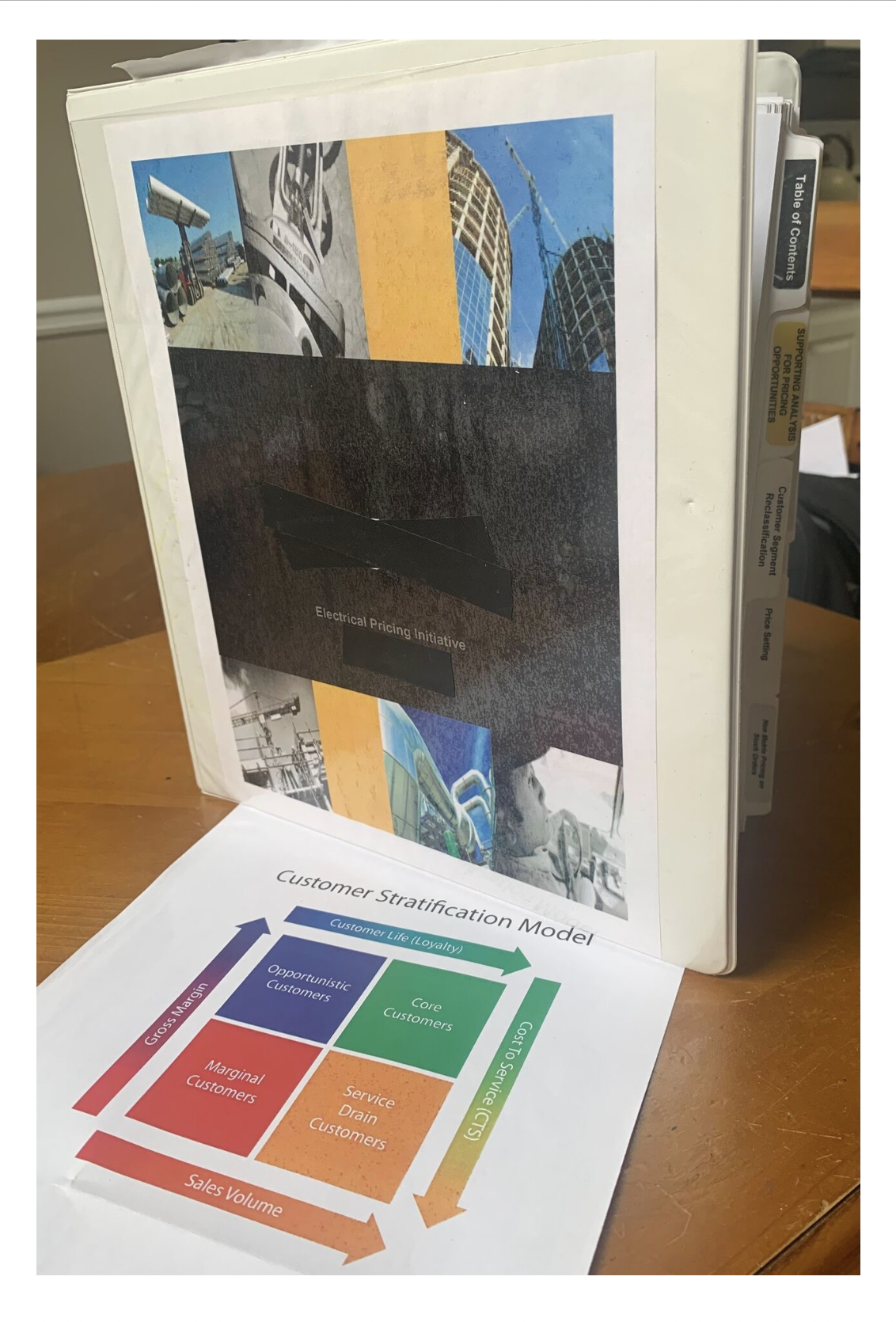

I found in the archives my personal pricing Encyclopedia Britannia (the Complex) and the Texas A&M Industrial Distribution Customer Stratification Model (the Simple) and it made me think about what has changed in terms of customer stratification the past 10-15 years.

Since I happen to work closely with two of the three authors and creators of the original Texas A&M Customer Stratification Model (Senthil and Pradip). I thought I would ask them how they they think their customer stratification model has evolved in distribution the past 15 years.

What factors have changed in proper customer stratification?

“A lot of the basic foundational elements are unchanged. When we designed the original model, the goal was to help distributors understand that not all customers are equal, and to give them a simple stratification process to use. The whole goal was to get them to move customers from marginal and service drain to the right and up on the grid.” said Senthil Gunasekaran

“It was about helping them focus on where to grow smartly. For example – if you had too many customers who did big volumes at poor margin levels these service drain customers could really bring your business down,” said Pradip Krishnadevarajan

What they shared on some important changes to the original model-

- The big change has been much more data and customer interaction through digital platforms has made it easier to identify where you have a “marginal customer” who actually could be a “core customer” if they bought products they buy elsewhere from you. Potential total sales back when this model was launched were much harder to understand and adjust. If a customer clicks on an item on your site, but never buys it chances are they will buy it somewhere else.

- Understanding how the customer fits into the total business. For example – large service drain customers do high volumes at lower GM% levels, but this volume is also the main driver of your manufacturer rebates and incentives. If you drive these services drain customers away it can hurt your rebates and incentive payments with manufacturers. Rebates continue to grow in importance and impact on the business every year, so driving away service drain customers may not always be a great business choice.

“The customer stratification module now has more depth than it did a decade ago, because you have a much clearer picture of the customer’s total business potential. When we started you really only had the view of what that one customer bought with that one distributor.” said Senthil

That is an important point to remember and consider. With more data points available today you can determine where you have a” marginal customer” that is a “core customer” in potential. This helps you make better commercial pricing decisions, that grow GM% and top line sales.

I think it is a good reminder that you need the discipline of a process manual, and an execution plan (like the one shown in the 266-page manual in the photo).

It took a lot of work with many great teammates to build this Complex process manual to catch every profit dollar possible. FYI – The pricing matrix a decade and customer and product segmentation model and process is basically unchanged for many in distribution today. In the shameless plug category, you can find Senthil, Pradip, and Barry Lawrence’s groundbreaking book which is still a top seller for NAW for purchase E-BOOK – Customer Stratification: Best Practices for Boosting Profitability | National Association of Wholesaler-Distributors (naw.org)

What many data, inventory, category and pricing leaders miss is you need the Simple (Customer Stratification) to make these complex processes like pricing understandable and executable by your organization.

For example – your sales team can understand the graphics, but if you hand them the 266-page manual, they will flee the premises. Without organizational Buy In you are just moving numbers around on the page and will never execute and truly add value.

This simple approach makes the conversations about what we can do as an organization to move customers to grow GM% and Sales much easier to understand. The equation for success for most distributors is pretty simple: better data = better commercial decision.

To be truly effective today, you can’t be too complex or too simple when it comes to customer stratification and pricing to effectively move your business forward.

As always we appreciate your comments and feedback.

Leave a Reply