An uneven HVACR Market and some supply chain restraints created a flat sales environment for AAON in their Q2 results.

AAON – AAON, the Tulsa, Oklahoma headquartered HVAC manufacturer of HVAC equipment for commercial and industrial markets, announced 2Q 2025 earnings on August 11.

Net sales during 2Q decreased 0.6% to $311.6 million. The year-over-year decline was driven by the AAON Oklahoma segment, which realized an 18.0% decrease in net sales. Although backlog at the segment was strong entering the quarter, supply chain constraints limited AAON’s ability to ramp production. There is some evidence that momentum is turning as July was the strongest month this year. The BASX and AAON Coil Products segments realized sales growth of 20.4% and 86.4%, respectively. Both segments benefited from strong year-over-year demand for BASX-branded data center equipment. However, ERP implementation limited production for the Coil Products segment.

The BASX data center sales were up 127% in the quarter and are up 269% year-to-date. BASX has a partnership with Applied Digital to supply unique cooling systems for their AI data centers.

From a channel perspective, AAON national accounts strategy is gaining traction with orders up 163% in Q2.

Gross profit margin was 26.6%, down from 36.1% in prior year, nearly one thousand basis points. The contraction in gross profit margin was primarily a result of lower production volumes at the AAON Oklahoma segment, and operational execution issues and inefficiencies caused by the ERP implementation.

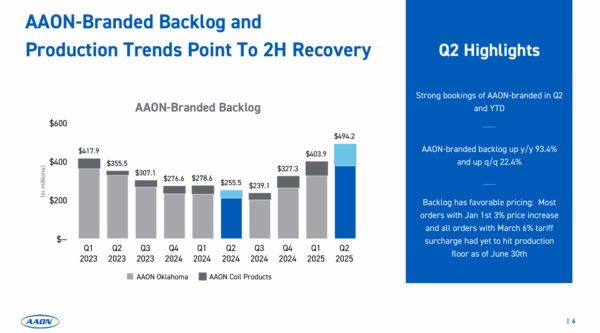

AAON reduced its full-year 2025 guidance, raising questions about recovery and execution. The one positive was that backlog trends are strong:

Shareholders expressed concerns over profit decline and margin compression. Execution of the ERP implementation raised red flags – AAON’s new SAP system rollout at its Longview facility created major production disruptions, causing a cascading effect. Coil production problems limited output at the Tulsa plant, and two external coil suppliers also faced issues. These operational setbacks contributed to ~$35million lost sales and reduced margins by approximately $20million, driving the broad-based earnings deterioration. Segment volatility underscores ongoing operational risks – AAON Oklahoma, the largest segment, saw an 18% sales drop and a sharp margin contraction and the AAON Coil Products segment grew sales due to BASX equipment sales to data centers, but gross margin collapsed to 22% – attributable to ERP challenges.

In addition, operating cash flow swung negative ($-31million versus a $128million inflow prior year), and free cash flow declined. To fund inventory and contract work, AAON expanded its revolving credit facility, raising questions about near-term liquidity management.

As always, we appreciate your comments and support. Please feel free to reach to me with any questions directly.

Leave a Reply