The “go-go” days of post-Covid are gone. We’re back to pre-pandemic industry growth rates. Maintaining, and improving, net profitability in the face of slowing growth, increased cost structure, and stagnant (if not decreasing) margins, requires improved operational efficiency, inventory management, strategic price management, appropriate implementation and utilization of technology, intentional growth strategies supported by marketing that is a force multiplier and, for some, scaling up.

It requires focus.

It requires a commitment to operational excellence.

Will Quinn, “The Distribution Guy”, and Global Director, Strategy Infor Warehouse Management (WMS), shared some thoughts on how distributors can improve their bottom-line. It comes down to focusing on three things:

- Cost Control and Profitability Strategies

- Operational Efficiency

- Utilizing Data Analytics for Enhanced Financial Decision Making

Improving Financial Management and Cost Efficiency

Maintaining a balance between expenses and profits is critical for long-term success in the rapidly evolving electrical distribution sector. The key is being proactive. While many of the following strategies may seem “basic” to some distributors, their consistent and effective implementation sets successful companies apart.

This article explores various financial management and cost-efficiency strategies for electrical distributors. They include methods for optimizing inventory management, strengthening supplier relationships, and maximizing operational efficiency.

Further, distributors can benefit from the transformative power of data analytics and cloud-based ERP systems. These tools can equip electrical distributors with the insights needed to improve decisions, leading to cost savings and a strengthened position in the market.

Cost Control and Profitability Strategies

- Enhanced Inventory Management

Inventory management is crucial to cost control. Leading distributors are employing analytics in inventory management systems. These systems can accurately forecast demand by leveraging historical sales data and market insights, ensuring optimal inventory levels. This enhances customer satisfaction by preventing missed sales opportunities while limiting inventory investment. Thus, the strategic use of analytics in inventory management is a surefire way to reduce costs and prevent obsolete inventory.

- Strengthening Supplier Relationships

Strong supplier relationships can translate into favorable pricing structures and contractual terms. Engaging in sourcing practices and negotiating beneficial agreements can drive sales with key suppliers.

Indeed, supplier performance data is instrumental in identifying not just cost-efficient partners but also the most profitable ones. Cost-efficient partners are essential because of their high order accuracy, which minimizes costs associated with service issues and bloated inventory. Your most profitable partners offer high net margins, contributing significantly to your bottom line.

Swift and effective methods are important in evaluating supplier performance during the receiving process, as it prevents operational slowdowns. Substandard supplier performance compromises your operation’s efficiency, potentially leading to stock shortages. Therefore, balancing cost-efficiency and profitability is critical in supplier management.

Operational Efficiency

Operational efficiency is indeed a potent mechanism for cost management. Implementing automation, optimizing your warehouse’s layout, and lean manufacturing principles will reduce waste and boost productivity. By reducing travel and integrating task interleaving, your workforce can achieve more in less time, decreasing operational costs and enhancing overall productivity.

Achieving this level of efficiency requires strategic planning and execution. This is where an MT Cloud-based Warehouse Management System (WMS) can play a pivotal role. A cloud-based WMS streamlines operations, provides real-time inventory visibility, and improves labor efficiency. It automates various tasks, reduces manual errors and saves time. A multi-tenant cloud architecture facilitates consolidating your valuable data into a data lake. This data aggregation ensures efficient storage and enhances the utility of advanced tools such as Artificial Intelligence (AI) and Machine Learning (ML). These tools can then leverage this comprehensive data repository to generate insightful and actionable intelligence.

Utilizing Data Analytics for Enhanced Financial Decision Making

Data is indeed the lifeblood of tomorrow’s management. By harnessing data analytics, electrical distributors can glean valuable insights into their operations, enabling you to make informed decisions that bolster profitability. Real-time financial monitoring equips you with instant visibility into your economic performance, facilitating swift decision-making and necessary adjustments.

The transformative power of real-time monitoring in financial management lies in its ability to track key metrics in real-time. These could include revenue, costs, profit margins, and cash flow. The number of metrics to monitor per functional area depends on the complexity of your operations. A good rule of thumb is focusing on 5-7 key metrics that directly impact your bottom line. This ensures effective management without overwhelming decision-makers. Remember, the goal is to track those metrics that provide the most significant insights into your business.

Here’s how real-time monitoring transforms financial management:

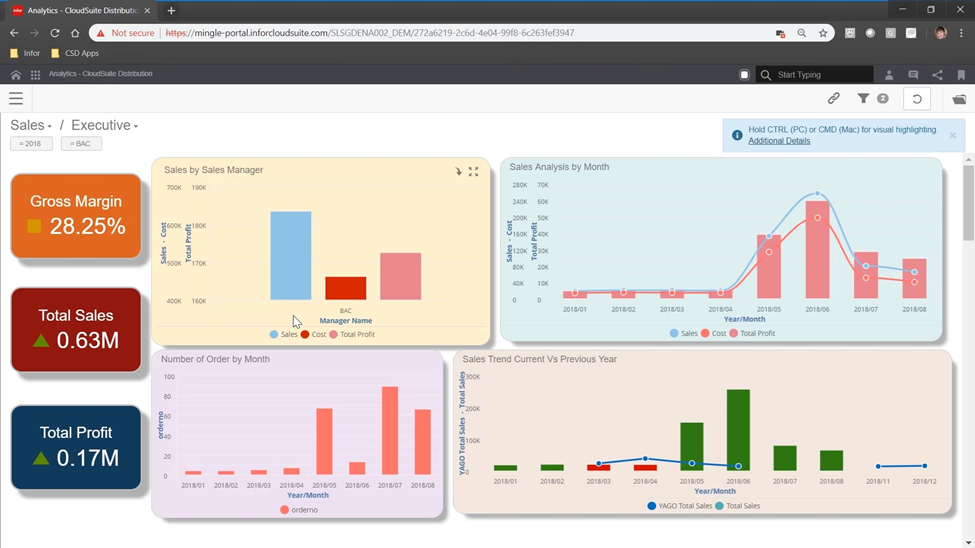

- Data-Driven Dashboards and KPIs: Real-time monitoring goes hand-in-hand with user-friendly dashboards and clearly defined Key Performance Indicators (KPIs). Dashboards are customized to display the most critical financial information relevant to specific roles or departments. This allows executives to quickly grasp the company’s financial health and drill down into specific areas for deeper analysis. KPIs like cost per unit sold, inventory turnover ratio, and customer retention cost become benchmarks for measuring progress toward financial goals. Real-time monitoring of these KPIs allows for continuous evaluation and ensures the company stays on track to achieve its goals.

Predictive Analytics: Looking Beyond the Horizon

Financial data analysis isn’t just about understanding the past. Real-time data empowers companies to leverage predictive analytics when combined with historical information. Machine learning algorithms can analyze data to identify patterns and trends, allowing for forecasting performance. Here’s how predictive analytics benefits financial management:

- Optimizing Cash Flow: Forecasting cash flow is a powerful tool. By harnessing real-time data on sales trends, customer payment history, and operational expenses, companies can anticipate and effectively navigate their financial landscape. This proactive approach to economic management opens a world of opportunities. It equips executives with the necessary insights to strategically allocate resources, devise effective borrowing strategies, and identify lucrative investment opportunities. In essence, cash flow forecasting catalyzes growth.

- Adaptive Inventory Management: Predicting future demand, especially in a project-driven business environment, is complex yet rewarding. Companies can leverage real-time data on sales trends, customer buying patterns, and project timelines to optimize inventory levels. Advanced machine learning models can be trained to understand these patterns and forecast future demand, even when a significant portion of the business is driven by inconsistent project work. This adaptive approach ensures you maintain sufficient stock while avoiding the financial burden of excess inventory. In essence, it’s about transforming unpredictability into a strategic advantage.

The Significance of Data in Financial Management

In today’s dynamic business environment, data is the lifeblood of effective financial management. By leveraging data analytics, electrical distributors can better understand their financial health and make improved decisions to drive profitability and growth. Here’s how data empowers financial management:

- Empowering Informed Decision Making: Data analytics is a powerful tool that replaces guesswork with concrete evidence. It utilizes a variety of sources to gather information. Historical financial data, sales trends, and market insights are obtained through internal records and databases. Competitive analysis, on the other hand, is derived from industry reports, public financial statements, and market research. These diverse data sets are then fed into analytical tools, which process and interpret the information to provide a comprehensive picture of the company’s financial landscape. This detailed view enables executives to make informed, data-driven decisions regarding resource allocation, budgeting, investment opportunities, and pricing strategies.

- Risk Mitigation: Financial risks are inherent in any business. Data analytics plays a role in proactive risk management. By analyzing historical data and identifying patterns, companies can anticipate risks, such as fluctuations in material costs, changes in customer demand, or potential cash flow shortfalls. A proactive approach minimizes the impact of unforeseen events and safeguards the company stability.

- Predictive Analytics: Data analytics goes beyond just analyzing past performance. Advanced analytics and machine learning algorithms can be used to forecast trends. This allows companies to predict cash flow needs, anticipate changes in customer demand, and optimize inventory levels. Predictive insights empower executives to make proactive decisions about resource allocation, production planning, and marketing strategies.

In conclusion

Effective financial management and cost efficiency are crucial for profitability and expansion. Companies can manage expenses effectively and increase profits by optimizing inventory management, strengthening supplier relationships, and enhancing effectiveness. Data analytics for time tracking, predictive forecasting, and cost-benefit analysis further facilitate informed decision-making.

Moving your ERP system to the cloud and utilizing data lakes can unleash the potential of AI and ML technologies, offering tools for financial management.

The updates improve scalability and data security, allowing for data analysis and predictive insights. C-level executives must adopt these methods and technologies to keep up with the changing market. Forward-looking HVACR distributors will be able to manage costs and profits effectively and accurately by focusing on data-driven choices and updating systems.

For more information, contact will.quinn@infor.com or visit www.infor.com.

Takeaways

- Distributors need to focus their efforts, and potentially invest in resources, to ensure long-term profitability. Growth is important but unprofitable growth will kill a company. Contrary to many salespeople’s opinion, not every sales dollar is good; not every gross profit dollar is good. It is about net profit. While a key metric in distribution is gross margin dollars / invoice, at the same time, cost / invoice is also critical. The difference is called “profit.”

- Ensuring, and improving, distributor net profitability is also in the best interests of manufacturers. The more profitable distributors are, the more they can invest into their business … and possibly into resources to grow their business. The terms that many are starting to use are “frictionless” and “seamless” interactions. The net result is a much better flow supporting industry transactions and information. It does not mean it needs to be “peopleless”, but the role of people needs to be more effective and efficient.

- Will brings up many good points. Distributors need to evaluate themselves against his criteria and manufacturers may want to consider how they evaluate distributors based upon “relationship efficiency” as, after all, it correlates to the profitability of the relationship.

Leave a Reply