We’re taking a deep dive on the latest earnings results from HVAC manufacturer Lennox in this column.

There was little discussion on tariffs, with Lennox baking tariffs into their 2H 2025 guidance and stating that the tariff impact is expected to be half of what it looked like in 1Q, which was $50 million. A substantial portion of the surcharges from April tariffs were removed, and they have proactively mitigated tariff impacts by switching suppliers, focused on productivity and cost control, and finally, pricing.

Lennox, posted revenues of $1.5 billion for the quarter ended June 2025, up 3%. More impressively, segment profit climbed 11% to $354 million, with segment profit margin expanding 170 basis points to 23.6%. This reaffirms their strategy to recapture share and drive margin expansion through better distribution.

Lennox’s Home Comfort Solutions segment, which represents approximately two-thirds of total revenue, grew 3% year-over-year to $1.009 billion. Despite a 9% volume decline attributed to R410A destocking and softness in residential new construction, offset by favorable mix and better than expected pricing, up 12%.

The Building Climate Solutions segment demonstrated stronger revenue growth of 5%, reaching $492 million. This segment also experienced volume challenges (-3%), but volume is improving, and benefited from an 8% boost from mix and pricing. The rebound came in the second quarter as customers regained confidence, while industry shipment volume is down double-digits.

Lennox noted that emergency replacement demand is strong, and that partially offsetting weakness in other market segments.

From a segment perspective, Lennox’s Home Comfort Solutions segment (about two-thirds of total revenue) grew 3% year-over-year to $1.009 billion. Despite a 9% volume decline attributed to R410A destocking and softness in residential new construction, the segment achieved a 12% increase from favorable mix and pricing.

The Building Climate Solutions segment demonstrated stronger revenue growth of 5%, reaching $492 million. This segment also experienced volume challenges (-3%) but benefited from an 8% boost from mix and pricing.

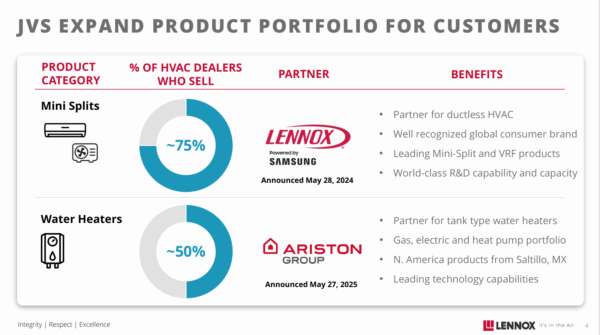

A key focus of Lennox’s -presentation was its expansion into complementary product categories through strategic joint ventures. The company has formed partnerships with Samsung (May 28) for mini-split systems and with Ariston Group (May 27) for water heaters, both representing significant growth opportunities. HVAC dealers already sell these products, so there is only upside (75% dealers participate in mini-splits and 50% dealers in water heaters).

Lennox highlighted the transition from R410A to R454B, which they noted has created temporary challenges, including canister shortages and dealer uncertainty, however, this is the path to gain long-term regulatory compliance.

Lennox’s outlook for 2H25 was revised sightly upwards based on the strong 1H performance, Lennox raised its full-year adjusted EPS guidance and projects total revenue growth of approximately 3% for 2025. They expect the market to stabilize in the second half of the year.

Lennox expects continued inflation of approximately 6% and plans to offset this through productivity improvements and cost actions of around $75 million. Lennox will continue to face headwinds of inflation, tariff pressures, and the complex transition to new refrigerants. Management has been effectively navigating these challenges.

Other headwinds mentioned include:

- Continued softness in the light commercial HVAC market could affect future sales, underpinned by the weak residential construction market. Translated, economic health of consumers.

- Uncertainty remains around tariffs.

- Potential supply chain disruptions that may impact production and distribution.

- The trend of repair versus replacement in HVAC systems may affect new sales.

There were a number of questions on price and mix, and CEO Alok Miskara revealed an interesting AI application that “each region (in the US) and each local ZIP code has its own pricing. So we continuously, on a daily basis, manage that and have now started using some really good tools, AI based tools, and a lot of data to make those decisions.”

Stakeholder discussion focused on second half expectations, volumes and elevated inventories. There was an interesting exchange on expanding products and services where the CEO stated that that the JVs on mini-splits and water heaters was a fast way to get to market with well-established products, while in other parts and supplies, it would be through distribution. “We would be obviously very open to acquisitions. I mean, from our perspective, we have a highly underutilized distribution network. And 250 stores could add a lot more products compared to what we are selling today without adding that much fixed cost.”

As always, we appreciate your support, comments, and consideration.

Leave a Reply