Masco’s Q2 2025 earnings report was a study in contrasts. For those of us watching the residential HVAC space, it offered a few clear signals.

Headline numbers:

- Adjusted gross margin improved to 37.7%, up 10 basis points.

- Revenue was $2.05 billion, down 2% year-over-year. Adjusted for currency and divestitures, it was flat.

- Adjusted operating margin rose to 20.1%, up 100 basis points.

- Adjusted EPS climbed 8% to $1.30, beating expectations.

- 1.6 million shares were repurchased in the quarter, totaling $101 million.

- FY25 adjusted EPS guidance was reaffirmed at $3.90 to $4.10.

Plumbing Products: A quiet win for the pro channel

The clear bright spot was Plumbing Products, which includes Delta and Hansgrohe. Segment sales were up 5%, with North American sales up 5% as well. Operating profit rose 11% to $276 million, with margin expansion of 110 basis points. Pricing and cost discipline made the difference.

This kind of margin growth, even with modest revenue gains, points to strong demand for higher-end, pro-preferred SKUs. It also reinforces what we are hearing elsewhere: the repair and remodel market is holding steady especially among skilled trades doing meaningful work.

Paint falters but that is not the story for HVAC

Decorative Architectural Products was down 12% overall. Removing the impact of the Kichler divestiture, it was still off by 4%. The weakness came from DIY paint, which dropped by high single digits. PRO paint rose mid-single digits.

This segment leans heavily on big-box retail and DIY. From an HVAC perspective, that part of the business is mostly noise.

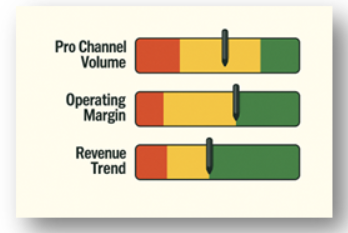

Channel mix tells the story

Masco’s 2024 channel mix data is telling. Plumbing Products went 52% through wholesale/trade/dealer, 19% through retail, and 18% via e-commerce. That maps closely to the HVAC channel.

Their growth is coming from pros. Not homeowners. Not online shoppers.

This lines up with what we are hearing across the board contractors are still working. They are not booming, but they are busy enough to keep pushing demand for equipment and install-grade products.

Takeaways for HVAC channel leaders:

- Pros are still buying. Focused, intentional purchases for upgrade and replacement work.

- Cost control and pricing discipline are driving margins. HVAC manufacturers and distributors should take note.

- The pro channel is still the engine. Residential R&R lives and dies here.

Masco does not make HVAC systems. But the performance of their plumbing segment stable volume, expanding margins, and strong pro-channel demand offers useful clues. The market is not hot, but it is working.

Bottom line (with extra context):

Masco does not make or sell HVAC equipment. But the plumbing segment performance volume holding steady, margins improving, and strength in pro channels is a bellwether for trade-led service and upgrade activity. Analysts cheered the results, boosting the stock ~10% after the report, reflecting confidence in Masco’s ability to manage inflation, tariffs, and soft end-user sentiment. In short: the prochannel market is not booming, but it’s functional and contractors are still shopping. That’s the core signal to an HVAC audience.

- Are you seeing similar signals in your own business? Is the pro channel in your territory holding steady, or are you starting to notice more softness?

- Let us know what you’re hearing and if you want to dive deeper into what this means for your own strategy, we’re here to help. If you are aligned with the pro channel and supporting real-world contractor work, you are still in the game.

As always, we appreciate your comments and support.

Leave a Reply