As a former pricing leader for three billion-dollar distributors in North America, I can share from experience that a major pricing reset is simultaneously a dangerous activity, yet when done right, the best driver of top-line sales growth in this industry.

Earlier this year, I wrote a Case Study for Modern Distribution Management (MDM) on the pricing reset MSC Industrial had publicly announced they were undertaking in 2024.

I applaud MSC for the effort and as a public company announcing they are doing it as a major initiative (which is rare). So, what can you learn as an HVACR Channel leader about a pricing reset to consider for your business?

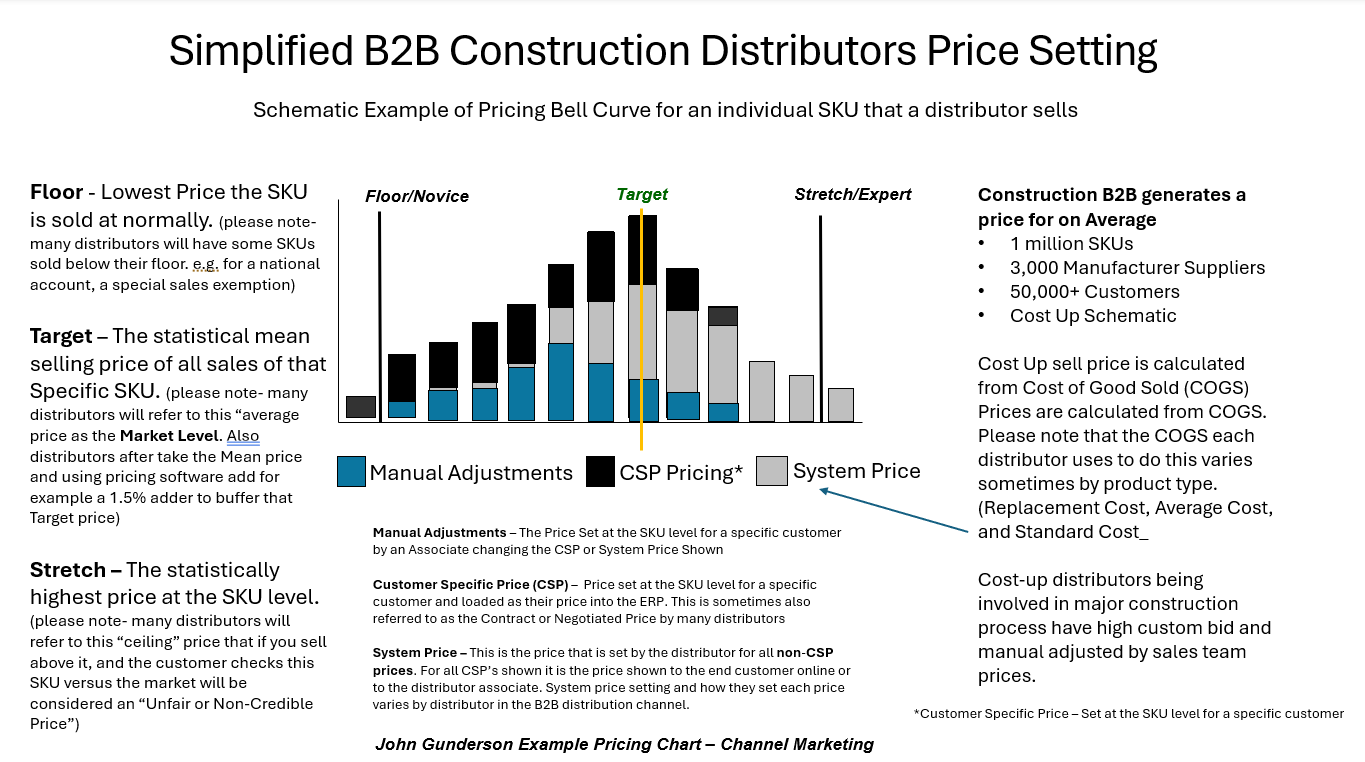

Let’s start with an overview on how Sell Prices are set by many HVACR distributors in the above chart – I created.

The schematic example above is a high-level illustration of how the sell price is calculated/analyzed at most B2B distributors. Most pricing engines from service providers have a similar approach (Floor/Target/Stretch). Please note that some HVACR providers are cost up pricing and some are System Price/list down (where a multiplier is used to discount off of list)

Pricing engines and service providers start with analyzing all sales at the SKU level, all sell prices are analyzed from lowest to highest (for a 6- to 12-month period, typically) and the statistical mean for that SKU sales is roughly the target level.

There are many other factors — including size and type of customer and order type (stock versus direct) used in floor/target/stretch pricing, but to keep the example simple, I have not shown that complexity.

Many distributors consider the target price as the “not to sell below price.” It is considered the market level or “a fair and credible price” for their customers.

The floor also can be set during this process at the SKU level and this is considered the lowest level you should sell a product at, but, when you do, it has to have management sign-off and be for a strategic reason — e.g. for a top customer, “if I sell this SKU I get these other higher margin sales,” etc.

The stretch/expert level is the highest price, the math shows the market will bear. I often referred to this as the ceiling. The danger of the ceiling is if you have too much of your sales for a customer close to the ceiling, they often will reduce volume, as they do not see what they perceive as a fair and credible price.

That all sounds simple, but…and there is always a but when it comes to pricing. If you follow this model and push your pricing from left to right from Floor to Target, and Target to Stretch you keep raising your Target price.

Slowly but surely, you push the target higher and eventually you start to curtail top-line sales. Its not that you are doing anything wrong it’s that your competitors and still writing their orders at the same 2O% they always have and you no longer have “Fair and Credible Prices” in the

So, where do you start…. If you are using a pricing system similar to the above schematic using a CMG Pentagon pricing approach.

- Frontal assault – Lock in as many Customer Specific Prices (CSP) as the key customer level as possible with every manufacturer you support. Think short-term vs. long-term. Move your pricing team talent to lock in CSPs, Ship and Debits, rebates (whatever you call them) to get “fair and credible prices” with your top customers on their top A items. Lock in as much volume as possible on A items and then consider using that knowledge to tweak a floor/target/stretch pricing system. CSP management is a true advantage when we are in a time like now (with price increases coming and furious). If you receive a cost basis change you want to in real time show the impact to your business to your manufacturer/distributor partner. e.g. If you can create a report by customer that shows a manufacturer the impact of a “do now change” to your mutual largest customer. When presented with big risk to the business data, they will listen (e.g. possibly delay price increase for some time for a specific SKUs’ at specific customers). That time delay will help you work together, and can be used as a growth weapon with the key end customer to grow share.

- Flanking assault – When you can’t go with a frontal assault tactic like the above (because the manufacturer or you can’t push back the increase) you can strategically adjust your price increase on your top customers items over time.…”Hey Joe, I am willing to eat some of this price increase on these items for the next two months but can get you to but this product from me that you buy from so and so.”

- Guerilla warfare – Analyze your Floor/Target/Stretch prices against the competition on your Top A items for the your Top Customers. Understand where you are on the Milk, Bread, and Eggs part of your business. Then use that intelligence to go out and grow share. If your competition is a straight 20% player they will be just going up with the market and you can use that knowledge to attack them by customer with a plan. Maybe stay competitive on select A items for X customer and then get the margin you need on the B,C, and D’s using a floor/target/ceiling approach. The bigger the customer the more opportunity to get competitive pricing intelligence on key items. Then you can quietly be at one price for the best customer and in the market be at a higher price to make money. Guerrilla warfare tactics used against competitors who have simple pricing tactics will drive them nuts and make them waste time on worrying about what you are doing instead of serving their customers.

For the past number of months, David Gordon and I have been talking non-stop about pricing and have been busy helping many Industrial distributors and manufacturers with their “buy side” and “sell side” programs.

This is a concept that David came up with…that took our mutual 40+ years in distribution pricing and all our pages of powerpoints, training programs, and material and combined them into a unified approach.

We hope you enjoy our continuing CMG Pentagon pricing series, where we will share tactical programs that you can implement or consider implementing with your team during this busy time of System Cost changes.

As we go deeper into our Pentagon Pricing Series in HVACR Trends (HT) – we will be sharing many more tactical programs to consider. When we finish the series, we will also share our exclusive pricing survey results (we have been doing this survey work in the channel since 2014) in our annual CMG State of Pricing Report for HVACR readers.

If you want to get on the list to get the full report, please just send me an email @ jgunderson@channelmkt.com (we will release the full report in the next month).

We will be sharing more on our CMG State of Pricing report as we go continue our Pentagon pricing series over the next few weeks. As always, we appreciate your support and consideration, so please reach out to us with any comments.

Leave a Reply