At last month’s HARDI Conference, Quinn Carlson of Uplift Partners shared insights on the HVAC acquisition market. After the conference he shared his slides with interested parties. I reached out to discuss the trends he’s seeing and what we’re hearing, as well as seeing in other construction channels.

We then discussed private equity as an acquirer.

They’ve been active in some markets, less so in others. HVACR is one market that they are active … and even at the contractor level where a number of companies are developing “roll-ups.”

One of the things that endears the HVACR market to private equity is its multiple revenue streams.

In the HVAC segment, parts wear out.

The revenue streams are:

- New construction

- Renovation / remodeling

- And the service market.

While the new construction market can be cyclical. The renovation segment is less so and the service market generates consistent business.

Given this, the HVACR market can be attractive to private equity firms which is why there are a number of PE-backed platforms in the HVACR space … all looking to expand!

For a distributor seeking to exit the business, this is good as it creates an alternative to selling to a strategic buyer. And different PE firms have different models.

Quinn has had experience with a number of private equity firms. He shared his thoughts in this article below on private equity acquirers.

Are All PE firms Barbarians?

“When I was in business school, I had several professors tell me that I really ought to read Barbarians at the Gate (Bryan Burrough and John Helyar, 1989) to understand private equity. For those who haven’t read the book, the book describes a world in the late 1980s when so-called private equity investors (the “Barbarians”) began pooling together large sums of capital from banks, bond investors and from other equity investors (“a.k.a. “other people’s money”) to then pursue takeover or buyout transactions in what is now known as a leveraged buyout (“LBO”).

Once the LBO transaction was completed and the private equity firms assumed ownership and control, they would then hope that the newly acquired business would be able to pay down debt from future cash flows and/or they would also look to restructure / monetize parts of the business. If they were right, this investment would produce a handsome return for their investors and, of course, themselves.

The LBO concept exploded literally and figuratively. Some of these transactions played out in the public domain, such as the leveraged buyout of RJR Nabisco in 1989 and its subsequent “fall”, which is the main story in this book. But this book was not just entertaining; this book planted two seeds in the capital markets that have long shaped how business owners think about private equity. And business owners would be wise to reflect on how this market has evolved from its origins.

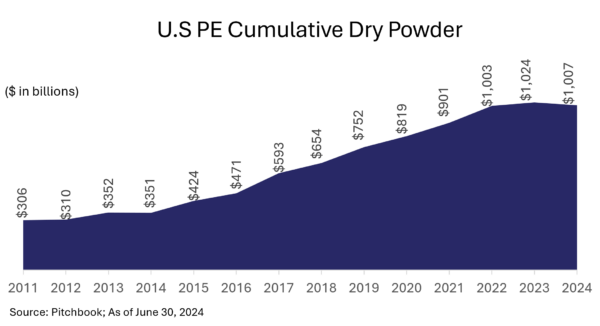

On the one hand, this book generated an almost deity-like reverence to the private equity titans behind the LBO and this newfound way to investment returns. Professionals, young and old, were drawn to making money in this way, and even more capital flowed, which led to even more people getting involved in exploiting these opportunities. Studying finance drew more students, further adding awareness and reverence to the private equity barbarians. With even more success – whether formed from pure luck or true investment savvy didn’t really matter, more people began exploring, experimenting, and, yes, innovating ways to take this concept across a wider array of opportunities. Today, nearly $1 trillion in equity capital is now flourishing on the sidelines awaiting to be deployed in private company transactions.

The second seed that was planted was the perception, which still exists today, that such private equity investors are nothing more than the barbarians that were personified in this book.

I routinely hear how business owners are very skeptical of private equity firms today and fear how their business and their legacy will be tarnished if they were to complete a transaction with such firms.

This perception is wildly mistaken and can lead to significant missed opportunities for business owners who are contemplating an exit strategy in the coming years. Note: there are certainly many private equity firms that are still barbarians to their very core. Business owners would be well-advised to steer clear of these animals.

However, as an M&A advisor to many family-owned and other closely-held businesses that were each seeking a great exit transaction, I have seen more and more private equity firms step up in our processes and give our clients very attractive and premium terms. With the vast expansion of capital available now, private equity firms have evolved themselves and are now drawing clearer lines of competitive distinction not only relative to strategic buyers but also relative to each other.

This competitive evolution is good news for business owners because it means they now have a) more exit options than they ever had previously, and b) to the extent such an exit transaction process is managed well, the competitive tension from the private equity market will drive stronger valuations. It is increasingly common for private equity firms to put forth more competitive proposals than even highly strategic acquirors. And not all PE firms operate the same. There are many that respect the legacy, involve prior ownership (if owners desire), embrace key management, and even some that are more “buy and hold.” Not every PE firm is seeking “a quick flip.”

The real opportunity here for business owners is not just to create a bigger sale price from this expanding capital base. Rather, what this market evolution has unlocked for business owners is a new opportunity to align their personal goals in partnership with a private equity firms who shares the vision on the growth prospects of a business and the means and experience to turn that vision into reality.

Many private equity firms are exceptionally good at growing companies through subsequent (“add-on”) acquisitions and allowing business owners to ride along beside them as equity partners as the platform enterprise appreciates. Often referred to as the “second bite” of the proverbial apple for business owners, this type of transaction is more difficult for strategic acquirors to pull off well as they typically will prefer owning 100% of an acquired business. Private equity firms, on the other hand, have become truly excellent in crafting this transaction for business owners and frequently leads to more interest and valuation from these firms in the process. Such a transaction, as long as it is done with a strong, growth-oriented private equity firm, allows business owners to participate in not just one liquidity event, but two and perhaps several more.

This can change the game as it relates to how business owners can now think about an exit. It is no longer a choice between a strategic acquiror and a barbarian. And the option does not have to be “sell and walkaway” shortly thereafter. They could still sell and walkaway, but the point here is they have way more private equity options now should they want to remain either invested operationally or financially for years to come. With many of our past clients, these once-skeptical business owners were not just happy they did a deal with private equity, but they are even prouder of the heights their legacies have stood as a result.

HVACR Distribution and PE Firms

The HVACR distribution industry is one vertical that we expect will continue to draw a significant amount of interest from private equity firms. The HVACR distribution industry has many natural strengths that attract a wide variety of investors, including having strong long-term tailwinds, a relatively fragmented competitive set, recurring demand and a history of innovation. Today there are less than 10 large PE-backed platform businesses in HVACR distribution among hundreds that are operating as family-owned or closely-held private companies. These investments have been very successful, which we expect will invite even more interest.

It will always be important to keep the barbarians well outside your gate. Now more than ever, you’ll be well advised to have an experienced hand guiding you down this path. The greater number of options out there to transact can only uplift your exit strategy if you can effectively compare and contrast the options. With an asset class of approximately $1 trillion today, it is now time to take a closer look at whether any of these descendants from barbarians might help build you a better gate and maybe even a larger estate.

About the Author

Quinn Carlson is a Managing Director at Uplift Partners, an M&A advisory firm based in Chicago. He has worked extensively with family-owned and entrepreneur-owned distribution businesses across the trade industries for more than a decade. Prior to founding Uplift Partners, Quinn was a senior member of the investment banking departments at Deutsche Bank Securities in New York and Duff & Phelps in Chicago. Quinn began his career at Ernst & Young Quinn can reached at 312-543-1815 or via email at quinn@upliftpartners.com.”

is a Managing Director at Uplift Partners, an M&A advisory firm based in Chicago. He has worked extensively with family-owned and entrepreneur-owned distribution businesses across the trade industries for more than a decade. Prior to founding Uplift Partners, Quinn was a senior member of the investment banking departments at Deutsche Bank Securities in New York and Duff & Phelps in Chicago. Quinn began his career at Ernst & Young Quinn can reached at 312-543-1815 or via email at quinn@upliftpartners.com.”

Take Aways

- If you are considering selling, considering a PE firm as an acquirer can help you optimize your outcome.

- Alternatively, there are PE firms that are willing to partner, and help fund, your growth, which creates an interesting alternative.

- Further, if you have a strong management team that may not be “cash-rich”, perhaps a PE firm would be willing to partner with them, and enable you to have a “second bite at the apple?”

The HVACR market is an intriguing sector for financial investors who are seeking to deploy billions of dollars. It could be a solution and something to learn more about.

Leave a Reply