The HVAC market slowdown is no longer a matter of debate or selective interpretation. Fourth-quarter performance came in worse than already lowered expectations, pricing pressure is beginning to surface in markets that historically hold firm, and inventory normalization remains unfinished. This isn’t a collapse scenario, but it is a clear signal that the industry reset is still underway.

What makes the current moment different is not the softness itself, but how broadly it’s showing up across residential, commercial, and distribution channels.

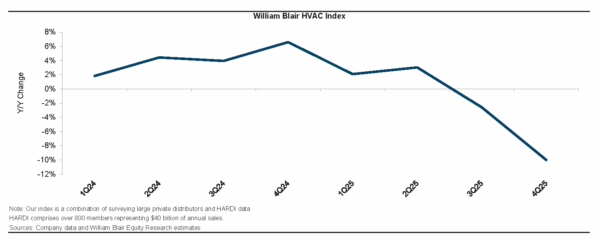

Fresh data confirms demand softness across the channel

Just released survey data from William Blair points to HVAC demand declining roughly 10% year over year, missing even conservative internal forecasts. Residential volumes are estimated down around 20%, while commercial demand is down low double digits. October and November were described as “remarkably slow,” with December improving only modestly by comparison.

Weather contributed, but this isn’t a weather-driven cycle. Sticker shock, weak residential construction, delayed replacement behavior, and cautious consumer spending continue to weigh on demand. Expectations for a quiet rebound in the second half of the year have not materialized.

For distributors and manufacturers, this confirms what has already been shaping daily decisions. Volume pressure is real, persistent, and not isolated to one region or customer segment.

HVAC market slowdown exposes early cracks in pricing discipline

One of the more important signals in the data is the emergence of pricing pressure in Florida and Texas. These markets have been consistent growth engines since the pandemic. When pricing competition shows up there, it rarely stays contained.

Residential price realization remains in the low teens, but that number requires context. Holding price while volumes fall sharply does not reflect true pricing power. Distributor margins are being supported by OEM rebates rather than clean price execution in the field.

That distinction matters. Rebate support can cushion margin erosion temporarily, but it does not change underlying competitive behavior. Once incentive structures adjust, pricing pressure typically becomes more visible, especially in replacement-driven markets.

Inventory normalization remains the gating factor

Channel inventories remain elevated, and while optimism persists around normalization by early spring, shipment data suggests the system is still digesting excess. AHRI sell-in volumes continue to decline faster than sell-through, reinforcing that destocking is ongoing.

Inventory behavior continues to shape pricing decisions, supplier programs, and sales urgency. Until the channel is materially cleaner, demand signals will remain noisy and competitive dynamics uneven.

This remains the central constraint on near-term recovery narratives.

Why company-level performance is diverging during the HVAC market slowdown

Not all companies are exposed equally. Manufacturers with backlog insulation, project-driven demand, or differentiated end markets are navigating the slowdown more effectively than those tied closely to residential replacement cycles.

Some manufacturers are benefiting from large project activity, data center exposure, and improving operational execution. Others are absorbing the full impact of distributor destocking and residential softness. This divergence reinforces that current performance is being driven more by mix and execution than by market momentum.

On the distribution side, margin sensitivity to volume declines and pricing pressure remains high. Long-term confidence in the channel remains intact, but near-term visibility is limited, and expectations continue to reset.

How this reframes expectations for 2026

A recurring theme in distributor commentary is the idea that 2026 may represent the first “normal” year since before the pandemic. No regulatory shocks. No extreme pricing behavior. Flattish volumes paired with modest price increases.

That framing is important. It reflects stabilization, not acceleration. A return to normalcy places greater emphasis on execution, cost discipline, sales productivity, and differentiation rather than macro tailwinds.

For the channel, that environment often feels more demanding than a growth cycle.

What this means right now

The HVAC market slowdown does not signal systemic risk, but it does confirm that the industry is still in a digestion phase. Demand remains softer than expected. Pricing pressure is emerging in key regions. Inventory cleanup is not complete.

The companies that navigate this period most effectively will not be those waiting for demand to rebound, but those tightening execution while others hesitate. The reset is still underway, and it continues to separate disciplined operators from passive participants.

What are you seeing in your market? Leave a comment or send me an email at clabow@channelmkt.com. If you are looking for more specific data for your market get in touch with us to discuss a survey based on your specific situation.

Leave a Reply