Strong Order Growth and Record Backlog Accelerating, Separation Tracking Ahead of Schedule

Honeywell Q4 earnings reflect a company in transition, posting strong results while preparing for a major restructuring in 2026. Now headquartered in Charlotte, North Carolina, Honeywell is a multinational conglomerate known for its building technologies, aerospace systems, materials, and safety and productivity solutions. The company reported Q4 2025 and full year 2025 results on January 29.

Honeywell Q4 Earnings: Key Results

Honeywell topped revenue expectations again, with sales of $9.8 billion, up 8%, and organic sales up 11% year-over-year. Strong demand in Aerospace Technologies (strong double-digit growth), Energy & Sustainability (double-digit order growth), and Building Automation led the way. Orders are up 23%, pushing backlog above $37 billion.

Operating margin dropped to 10.2% (down 640 basis points) due to one-time charges related to divestitures and Aerospace litigation. Excluding those items, adjusted segment profit increased 23%.

Full Year 2025 Performance

For the full year, reported sales increased 8% and adjusted sales increased 9%, with organic sales up 7%. Operating income decreased 6% and operating margin contracted 250 basis points, while adjusted segment profit grew 11% and adjusted segment margin expanded 40 basis points to 22.5%.

Honeywell does not report geographic results quarterly. For full year 2024, U.S. revenue accounted for 57% and Europe 23%. (2025 geographic data will be available with the annual report.)

Complex Restructuring in 2026

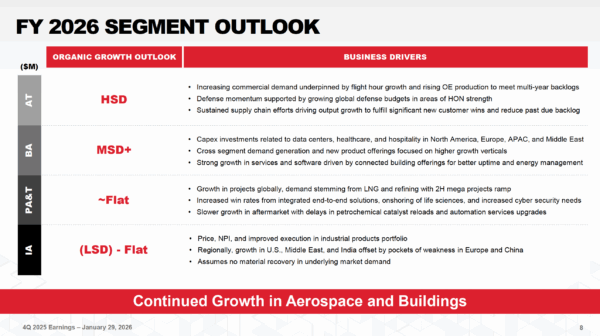

The transition is ahead of schedule, with portfolio simplification paving a clear path for Automation as an industry-leading pure-play. Honeywell is exiting more cyclical and capital-intensive businesses. The Aerospace spin-off is expected Q3 2026 and a leadership team was announced. The new reporting structure takes effect Q1 2026 and will include Aerospace Technologies (exiting Q3 2026), Building Automation, Process Automation, and Industrial Automation.

Distributor Relevance

Distributors are most interested in Honeywell Building Automation and carry Honeywell HVAC and building management, lighting controls, safety and fire systems, and other products. To a more limited extent, specialized distributors carry Honeywell Industrial Automation products, including robotics and process control solutions.

Relevant Segment Results

* PA&T = Process Automation & Technology * IA = Industrial Automation

Building Automation (about 18% of total sales) delivered high single-digit organic growth in Q4 2025, helping drive the company’s overall 11% organic sales increase. Strong demand for building management systems, automation and controls, and energy-efficiency solutions contributed to BA growth. No additional segment details were provided this quarter.

Energy and Sustainability Solutions (about 17% of total sales) orders in Q4 2025 grew double digits, driven by strong demand in UOP process technologies (Universal Oil Products: process technologies, catalysts, adsorbents, and equipment used in energy, refining, petrochemical, and renewable fuels industries), energy transition solutions, hydrogen and carbon-capture technologies, and industrial sustainability offerings. No additional segment details were provided this quarter.

Shareholder Concerns

Despite strong orders and healthy earnings per share, shareholder concerns centered around revenue misses, mixed segment performance, and uncertainty around the 2026 divestitures. With revenue lower than expectations, shareholders worried this signaled uneven demand across segments and potential pricing or volume pressure. Honeywell issued EPS guidance only for 2026, without revenue or margin guidance, raising concerns that limited visibility could signal caution about top-line growth. Macroeconomic uncertainty was a concern, as in many other earnings calls, with the revenue miss interpreted as a sign of volatile market demand, especially in non-Aerospace segments.

2026 Guidance

The company highlighted several demand drivers underpinning an increase in earnings estimates for 2026 (they offered no revenue or margin guidance), including growth in the BA and ESS segments, strong revenue visibility into 2026 with the record $37 billion backlog, and divestitures (sale of low-growth businesses like Warehouse & Workflow Solutions and Productivity Solutions and Services in H1 2026, as well as the Aerospace spin-off pulled forward to Q3).

Drivers for Building Automation’s medium single-digit growth outlook for 2026 include continued strong capex investments related to data centers and healthcare, cross-segment demand generation, new product offerings focused on higher-growth verticals, and strong growth in services and software driven by connected building offerings for better uptime and energy management.

Key Questions for Distributors to Track

These are the strategic questions distributors should monitor heading into 2026:

- Is Honeywell overly dependent on Aerospace for growth and can the other segments, especially Automation, scale at the same pace?

- What will be the impact of Honeywell losing its highest-growth, highest-margin business?

- Is the backlog converting to revenue fast enough?

- Will pricing pressures ease and what will be the impact on margin?

- When will demand softness in non-Aerospace segments strengthen?

- Can the remaining segments sustain growth without Aerospace?

- Can Building Automation sustain high single-digit growth?

- How does Honeywell’s competitive positioning compare to Siemens, Schneider, Rockwell, and ABB?

If this aligns with what you are seeing in your market, I would like to compare notes. CMG works with manufacturers, distributors, and rep firms who want clearer strategy, stronger channel performance, and better alignment across the field. If you are exploring ways to strengthen your commercial approach, reach out and let’s talk through what you are trying to build.

Leave a Reply