For the past number of months, David Gordon and I have been talking non-stop about pricing and have been busy helping many distributors and manufacturers with their “buy side” and “sell side” programs.

As a former pricing leader for two of the largest distributors in North America, I have been remiss in writing as much as we should about buy-side and sell-side pricing. So, we are filling that pricing content gap starting today with our “Pentagon Pricing” series, which we will be sharing over the next month plus.

This is a concept that David came up with…that took our mutual 40+ years in distribution pricing and all our pages of powerpoints, training programs, and material and combined them into a unified approach.

We hope you enjoy our CMG Pentagon pricing series, where we will share tactical programs that you can implement or consider implementing with your team during this busy time of System Cost changes.

So, let’s start this series with a quote I use often that I learned from Mark Sommers (long time industrial and electrical distribution leader) or John Tisera (Long time HVACR – Johnstone Supply CEO and Electrical Channel leader). I’m not sure which one of the two coined the phrase first, so I will give credit to both, and I am sure I have slightly modified it, over the past few years….but here it is.

“I Love Cost Changes….they give us the opportunity to play Offense and use price as a weapon”

John Tisera or Mark Sommers

With all the Price Increases and Cost Changes that are happening this year….this gives you and your team the opportunity to use price as a weapon to take share. No, this isn’t a column of how to use a cost advantage to bomb the market price to take share, but how you can use price excellence to be disciplined and win more orders at acceptable margins.

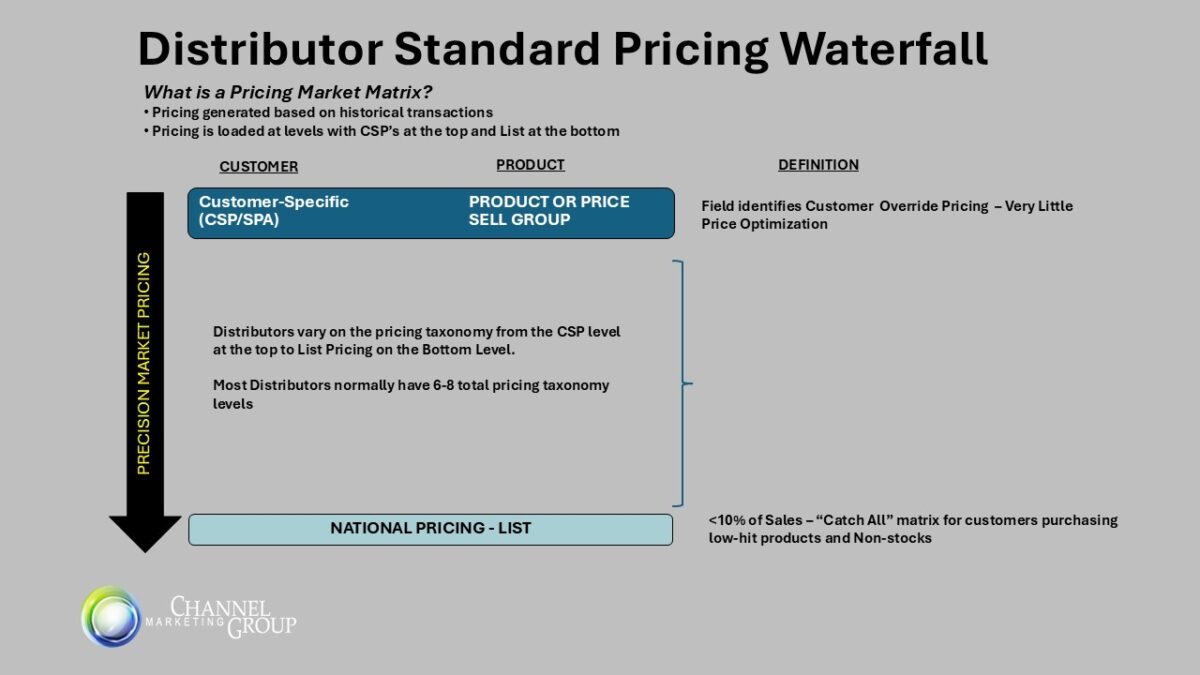

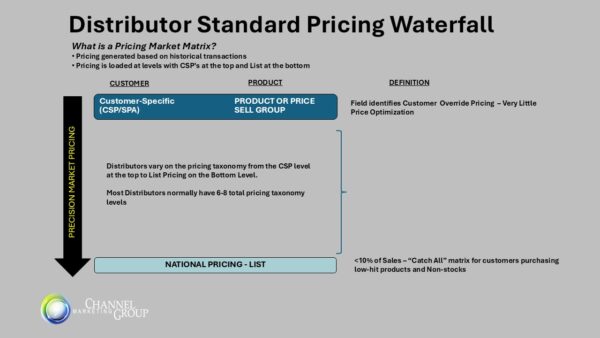

CMG Distributor Waterfall Example – 95% plus of Distributors have a Waterfall price process similar to what is shown above.

When you type in an order into Infor CSD, Eclipse, P21, Net Suite, SAP, or whatever ERP you use. The ERP’s first hit is to see if this SKU for this specific customer has a Customer Specific Price, Special Pricing Agreement, or Ship & Debit (whatever term you use for your business) for the SKU and customer intersection in the system. These are the “negotiated at the SKU level sell prices” for your best customers, and in most distributors (and manufacturers) these price types are large percentage of most distributors total business. For example: 20% of your SKU’s sold may be of this price type, but 40%+ of your total sales are of this price type.

I was talking with one of my pricing friends last week – Scott Sinning and the topic of all the current and future cost side changes came up…and instead of feeling of complete dread. We both were so excited about this being the BEST time for a sell side pricing team working closely with their sales teams to use “Offensive” pricing to win.

When buy side cost changes come in your pricing team must live at the top of your pricing matrix and play offense (see the graphic above). It is not strategic pricing time…it is tactical offensive warfare (Pentagon Pricing).

So, where do you start…. when cost side changes hit your desk.

- Frontal assault – Move the resources you have on your pricing team immediately to where it matters most – Customer Specific Pricing at the Key Customer. Think short term vs. long term. If you have someone on the team working all day on pricing optimization and creating a system/3rd column price that only accounts for 5% of your total sales. Move that talented person short term to helping on CSP sell side pricing. When that change comes in you want to in as close to real time show the impact to your business to your manufacturer/distributor partner. e.g. If you are a distributor and you can immediately create a report by customer that shows a manufacturer the impact of a “do now change” to your mutual largest customer. When presented with big risk to the business data, they will listen (e.g. delay a price increase for some time for a specific SKUs’ at specific customers). That time to work together can be used as a weapon with the key end customer. It’s the “Hey Joe, we have a cost increase coming and we value you so much, that we have worked with XYZ manufacturer to protect your price from now until XYZ conversation.”

- Flanking assault – When you can’t go with a frontal assault tactic like the above (because the manufacturer or you can’t push back the increase) you can strategically work your inventory you have in stock at a lower cost basis and play the blended (average) cost game tactically. It’s the “Hey Joe, you know costs are going up and that you are best partner, so I can do XYZ as an interim price for this amount of time. I am taking a haircut on that as I am sure you appreciate that…Can we talk about expanding sales in this category or do XYZ together.”

- Guerilla warfare – Use the cost side change data you gather to target your direct competitors and fight from the jungle. e.g. You could feign a run at a top customer and cause your competitor to devote more resources to a customer that you had little chance of moving. There are customers who don’t value the services you bring and are transactional buying only on price. Getting the competition to overserve that customer, causes means less time trying to try to grow their business with your customers who are loyal and generate fair margins.

The second reality in times of great cost changes is you find who as a distributor or manufacturer who is truly a partner. When that does occur, often due to the market conditions you will need to stealthily (guerilla style) move away from that partner as you find a true partner replacement.

As we go deeper into our Pentagon Pricing Series – we will be sharing many more tactical programs to consider. When we finish the series we will also share our exclusive pricing survey results (that we have been doing this survey work in the channel since 2014) in our annual CMG State of Pricing Report.

If you want to get on the list to get the full report, please just send me an email @ jgunderson@channelmkt.com. We will be sharing more on our CMG State of Pricing report as we go continue our Pentagon pricing series over the next few weeks.

As always, we appreciate your support and consideration so please reach out to us with any comments.