A few weeks back my colleague David Gordon wrote a column on Ferguson’s Q4 numbers. Ferguson added to that release with additional information that was contained in their full annual report. I wanted to see what the Ferguson Annual report had to share to our recent analysis in HVACRtrends, and the distributor series on Ferguson that I wrote for MDM. Did anything major change?

I like to really focus on the key pages in every annual report before the 10K from publicly traded companies. I believe the annual report often indicates what a company’s strategic pillars are for the upcoming year.

As David stated a few weeks back in his column the Ferguson Pillars are clear to see for 2024 and possibly for 2025.

Ferguson Q4 Earnings Report … Preparing for Increased HVAC Focus – HVACR Trends David’s article has some key insights on their total business that is a great read.

I took a few excerpts from David’s analysis and shared them below as Ferguson’s focus on the Dual trade contractor (Plumbing, HVACR) continues to be highlighted in their public information.

David’s Analysis – Ferguson HVAC Growth Plans

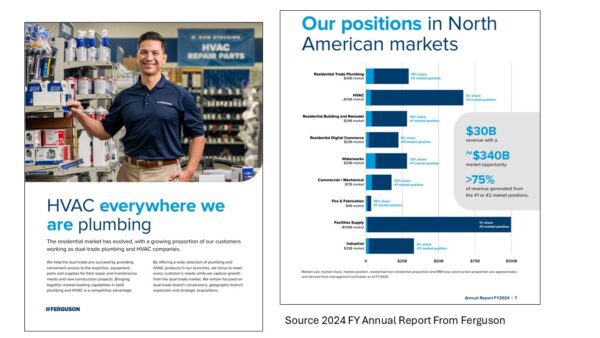

- “Our ability to bring together market leading capabilities in both plumbing and HVAC provides us with a competitive advantage for serving these professionals and capturing growth from this market for years to come. We estimate that the combined HVAC and residential trade plumbing markets to be approximately $100 billion, of which, we estimate nearly $30 billion of the market is serviced by more than 65,000 dual trade plumbing and HVAC professionals.”

- “We’re expanding our HVAC offering to match the density of our plumbing presence, executing this expansion through a combination of dual trade branch conversions, geographic branch expansion and acquisitions.”

David’s Analysis Thought – Ferguson is going to invest in expanding branches, HVAC inventory to support current plumbing locations, making acquisitions, and pursuing the commercial market. .

That focus that David outlines is key in my opinion.

I wrote a Case Study series on Ferguson for Modern Distribution Management, as I consider its strategic approach unique in the North American B2B distribution.

The Ferguson Series on MDM that I wrote makes it clear what we believe their focus is for 2025.

How Ferguson Worked Wonders with “Channel Drifting” Expansion – Modern Distribution Management

Inside Ferguson’s Private Brand Strategy – Modern Distribution Management

A Deep Dive into Ferguson’s Digital Strategy – Modern Distribution Management

So, it was fun to write this three-part series with Modern Distribution Management for MDM premium readers. I would encourage you to consider getting an MDM Premium subscription for your company to see the full series on MDM. P.S. MDM has other series I have written this year on Wesco, Fastenal and WATSCO that are comprehensive. A big thanks to that great team for the partnership and great editing on these distributor deep dives.

As a distributor or manufacturer in the channel, does that statement apply to your world view? Are you an HVACR distributor that is looking to diversify in other channels? The list of Channel drifter distributors that started in one channel and now are in electrical, PVF/Waterworks, plumbing, and HVACR is long and growing.

As always, we appreciate your comments and feedback.

Just some food for thought. Your thoughts?

Leave a Reply