Watsco’s Q3 2025 results offered a sigh of relief for HVAC distributors and manufacturers watching the A2L refrigerant transition unfold. Earnings per share of $3.98 missed Wall Street consensus by about 6 percent but came in ahead of buy-side expectations. That mix of mild disappointment and cautious optimism perfectly sums up where the HVAC channel sits today: weathering the transition without breaking stride.

Sales and Pricing: What the Watsco Q3 2025 Results Reveal

Sales fell roughly 4 percent year over year—better than expected but still reflecting subdued residential demand. Watsco called the environment “one of the most challenging in recent memory,” citing the A2L transition as the main drag on equipment volume. Unit sales dropped in the high teens, partially offset by about 13 percent price realization, or roughly 15 percent including tariff effects. Despite weaker volume, distributors have maintained pricing discipline, showing that market leaders can balance customer sensitivity with profitability.

Sequentially, sales were flat compared with Q2, which is unusual in a typically softer seasonal quarter. That suggests contractors are pacing their purchases—servicing and repairing rather than replacing—while homeowners wait for clarity on new equipment options and installation costs. The good news is that price integrity held firm across the network.

Margins and Costs: SG&A Stays Sticky

Gross margins landed at 27.5 percent, right in line with expectations and 130 basis points above the same quarter last year. That margin strength underscores how well distributors are managing pricing even as cost benefits from the pandemic-era inventory cycle fade. SG&A climbed 5 percent, reflecting higher labor, training, transportation, and facility expenses tied to A2L-related investments and ongoing technology and logistics upgrades. These are the same pain points many HVAC distributors are still feeling—costs that remain sticky even as sales soften.

International operations fell 14 percent compared to domestic sales down 3 percent, with 80 percent of Watsco’s branches still concentrated in the Sun Belt. The company expects cost pressures to ease in 2026 as the A2L transition stabilizes and last year’s investment wave rolls off.

Inventory and Outlook

Inventory levels are improving. Watsco’s Q3 2025 results show stock levels reduced by about $350 million sequentially and $500 million from peak levels, a sign that the industry is finding balance after last year’s overbuild. The company expects to exit 2025 near normalized levels, freeing up working capital and reducing carrying costs heading into next year.

However, the near-term outlook remains cautious. The fourth quarter will face a tough comparison, and management expects sales to be down more than 6 percent year over year. Flat residential volumes are projected for 2026, with a weak first quarter followed by gradual stabilization as consumer confidence and installer comfort with A2L refrigerants improve.

What It Means for the Channel

For the broader HVAC distribution community, Watsco’s Q3 2025 results paint a familiar picture: the A2L transition is temporarily slowing demand but not derailing the market. Distributors that have invested in training, logistics, and clear communication with contractors are setting the stage for long-term share gains once replacement activity rebounds. The lesson from Watsco is that pricing discipline and inventory control can sustain profitability even through regulatory turbulence.

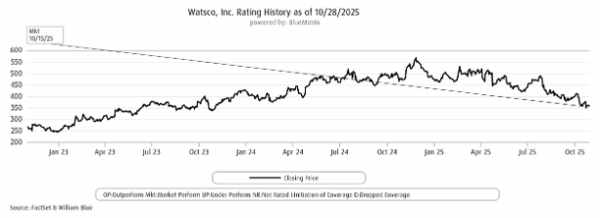

The channel has not escaped the woods, but the path forward is visible. If the largest distributor in North America can manage costs, trim inventory, and hold margins in one of the most complex regulatory transitions in decades, the rest of the industry can take heart—and take notes. For readers who want to see how this quarter compares with earlier performance, revisit our Watsco Q2 2025 analysis.

Source: William Blair Equity Research, “Watsco, Inc. – First Look: Not as Bad as Feared, but Not Out of the Woods Yet,” October 29, 2025.

Leave a Reply