Labor. Many have talked about it’s shortage. Be it a lack of electricians, a lack of qualified people for distributors to hire, or a lack of staff for manufacturers. Many have “blamed” Covid, the focus on “work from home”, an emerging “gig” / freelance economy, and other reasons. Lots of efforts, and initiatives, have been undertaken to “get people back to work.”

Recently, the Center for Manufacturing Research shared some insights in its current newsletter that documents the labor challenge and reinforces that there isn’t a “labor shortage”, which infers that there are ways to “quickly” recruit workers to jobs based upon “rationale” reasons. The research that the Center shared suggests the prospective workforce does not exist.

Who is the Center for Manufacturing Research?

The Center for Manufacturing Research is a non-profit nonprofit workforce development and education affiliate of the National Association of Manufacturers. It’s mission is “To build a resilient manufacturing workforce prepared for the challenges and opportunities of the future.” Some of the companies involved in the organization include Trane Technologies, Snap-On, PWC (Price Waterhouse Coopers), Nestle, Mazda, Toyota, Union Pacific Railroad, Deloitte Consulting and more … so, big name companies. Here’s a link to some of the research reports they’ve released.

The Lack of Labor Challenge

Back to the newsletter. Some information from their newsletter (and I’m copying / pasting some sections with commentary in parentheses and italics):

- The labor force participation rate for those aged 25-54 was 83.4% in May, the highest since January 2007. While there continues to be a debate about where the workers are, this suggests activity among prime-aged workers has bounced back. (so, those who are the core workforce are back to work.)

- Groups that have seen disproportionate declines in employment relative to pre-pandemic trends: the 55+ population, Black or African-American, Hispanic or Latino, and young men (aged 20-34) with less education. (as it relates to the over 55 population, early retirement from Covid did impact this group. Further, companies that initiated major layoffs during Covid may have also impacted this segment given higher compensation levels and overall business costs.)

- The biggest decline is among those ages 55+, who had a participation rate of 4% in April. This is down from 40.3% in February 2020. (interestingly, it’s a nominal decrease in the participation rate although a significant number of people.)

- The headline labor force participation rate remained at 62.6% in May, the same pace as in April and remaining the best rate in three years. The participation rate remained 0.8% below pre-pandemic levels but has trended higher in recent months. (With the participation rate pretty comparable to pre-pandemic, theoretically, the economy is back to a comparable number of employees.)

- However, there were 12,984,000 manufacturing employees in May, or just shy of February’s reading (12,988,000), which was the most since November 2008. (The same number of employees, however, demand for manufacturing employees has increased, and many companies are in the process of “re-shoring / near-shoring” plus the explosion in the automotive / EV market which will require many employees to staff the “billion plus” EV / battery construction projects that are underway throughout the country.)

The newsletter covered other areas of the labor challenge and shared other data (and if you’d like a copy, email me and I’ll forward it to you.) Additionally, the Center recommended this report from the Brookings Institution titled “Who’s Missing from the Post-Pandemic Labor Force?”

And some other thoughts:

- According to the World Health Organization, approximately 1.13 million people have died in the US, between January 3, 2020 to June 21, 2023, due to Covid. A percentage fit into the targeted work demographic of 25-54. (and whether you agree or disagree with the number, and Covid, it’s still many people missing from the workforce.)

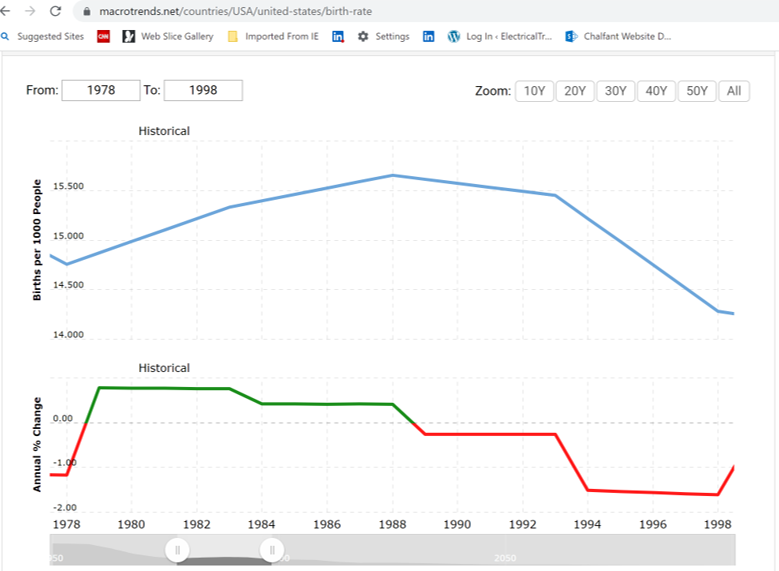

- Here’s some data on the US birth rate from 1978-1998 (that would be people who are 25-45 years old today … the people we’re trying to hire!). The green / red line at the bottom of the chart is the annual percentage change. It starts to decline in 1983!. Bottom line, a declining birth rate means less people coming into the workforce.

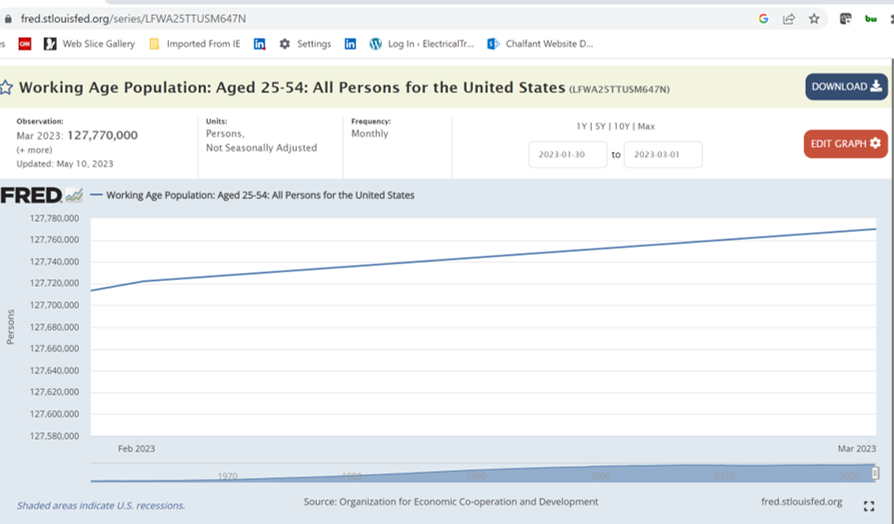

- And here’s a chart of the number of people in the 25-54 year range:

What does this mean for the HVAC industry?

Some thoughts:

- Companies need to automate / digitize as many repetitive activities as possible in order to either have longevity and/or enable them to scale. Why? Today’s workforce is going to be challenging to replace. Standardize as much as you can so you can manage by exception.

- AI will replace some roles, augment others. But, for AI to be most effective, companies need thinkers in critical roles.

- This month Channel Marketing Group participated in / presented on two webinars relating to digitalization.

- This digitalization of distribution webinar, conducted for Prokeep, shares thoughts on the macro dynamics and wholistic view needed to capitalize on the opportunities.

- This presentation on the future role of product data, which will be the fuel of distribution, shares a broad view of how data drives commerce in “tomorrow’s world” from manufacturer through rep to distributor and down to contractors, the jobsite and involves engineers.

And a caveat … I’m not endorsing any of the sponsors / products as distributors and manufacturers need to conduct their own due diligence.

- For your customers, it means that they will be automating as they cannot find people either.

- For contractors this means they will automate processes over time. On the jobsite they will need more tools to increase their productivity … back-office and on the jobsite. Manufacturers and distributors know this “game”. While the audience, as an aggregate, is slow to change, the larger and more progressive contractors, of all sizes, are seizing opportunities, implementing technology to improve processes and make themselves more efficient. Distributors (as well as manufacturers and reps) who understand contractor processes, needs, and technologies, will win more long-term. More will adopt services like Bluon, Kojo, Supplier Xchange and similar tools.

The labor challenge is not going to get resolved by the current generation except via automation. Investing in technology is not required based upon your goals. But if your goal is business longevity and business growth, automation as an operational and internal tool is important further, understanding how to sell technological products (robotics, process efficiency and more) is important which means changes in sales training, sales skills, and marketing to influence customers.