The nVent Portfolio Transformation Is Not Subtle / What the nVent Portfolio Transformation Means for the Channel

nVent’s Q4 2025 earnings tell two stories. The surface story is a record quarter with sales up 42% and backlog tripling to $2.3 billion. The deeper story, the one that should matter more to every distributor and rep carrying nVent products, is that this is not the same company it was 24 months ago. The nVent portfolio transformation that has unfolded across 2025 has strategic implications that go well beyond a strong set of quarterly numbers.

The Numbers Are Real

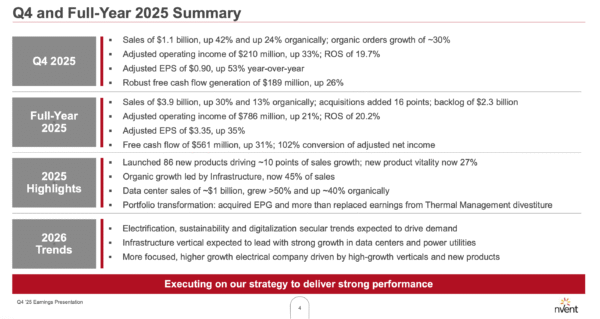

Start with what happened. nVent reported Q4 sales of roughly $1.07 billion, up 42% year-over-year. Organic growth accounted for 24 points of that, with acquisitions adding another 17 and a small FX tailwind covering the rest. Adjusted operating income was $210 million, up 33%, with return on sales at 19.7%. Adjusted EPS came in at $0.90, up 53%. Free cash flow for the quarter was $189 million, up 26%.

Start with what happened. nVent reported Q4 sales of roughly $1.07 billion, up 42% year-over-year. Organic growth accounted for 24 points of that, with acquisitions adding another 17 and a small FX tailwind covering the rest. Adjusted operating income was $210 million, up 33%, with return on sales at 19.7%. Adjusted EPS came in at $0.90, up 53%. Free cash flow for the quarter was $189 million, up 26%.

For the full year, sales hit $3.9 billion, up 30% with 13% organic growth. Adjusted operating income was $786 million at a 20.2% margin. Full-year free cash flow reached $561 million, up 31%, converting at 102% of adjusted net income. These are not modest improvements on a base business. These are the results of a nVent portfolio transformation that has been building momentum across every quarter of 2025.

Where the Growth Is and Where It Is Not

This is where the story gets uncomfortable for parts of the channel. Infrastructure, which now represents 45% of nVent’s total revenue, drove organic growth of 50 to 70% in Q4. Data center sales alone hit roughly $1 billion for the year, up more than 50% and about 40% organically. Power utilities accounted for roughly 15% of the portfolio by year-end, growing at solid double digits on the back of grid modernization, renewables integration, and electrification projects.

Industrial grew high single digits. Commercial and residential grew low single digits.

Read those last two sentences again. If your territory or your book of business is weighted toward commercial and residential, the growth engine at nVent is not pointed at you. That does not mean those segments are irrelevant. It means the energy, the investment, the new product development, and the strategic attention inside nVent are overwhelmingly flowing toward infrastructure, data centers, and utilities. The company’s 2026 vertical outlook says it plainly: Infrastructure is expected to lead, commercial is expected to “improve,” and industrial is projected at mid-single-digit growth. There is a clear hierarchy, and it is worth understanding where you sit in it.

The nVent Portfolio Transformation Is Not Subtle

nVent divested its Thermal Management business. It acquired Electrical Products Group (EPG) and Trachte, both of which are performing ahead of expectations. EPG added 6 points to Electrical Connections growth and roughly 17 points to the company’s total Q4 growth alongside other acquisitions. Management is not just growing organically. They are actively reshaping what nVent is.

In 2019, nVent’s portfolio was roughly 46% industrial and 32% commercial/residential, with infrastructure at 12%. Today, infrastructure is 45%, data centers alone are 25%, and power utilities are 15%. That is a complete inversion of the company’s center of gravity in six years.

The balance sheet supports more of this. Net debt to adjusted EBITDA sits at 1.6x against a target range of 2.0x to 2.5x. nVent has acquisition headroom and has said publicly that M&A remains a top capital allocation priority. The company returned $383 million to shareholders in 2025 through buybacks and dividends while still investing $93 million in capex, up 26%. If you are a rep or distributor, expect the product portfolio you are selling to continue evolving.

86 New Products and the Cooling Play

nVent launched 86 new products in 2025, contributing about 10 percentage points to total sales growth. New product vitality reached 27%. That is not a company resting on its installed base.

The liquid cooling platforms showcased at SC25, including row-based CDUs, next-gen PDUs, and AC/DC rack CDUs, are designed for the thermal loads that AI data centers are generating. nVent is collaborating with NVIDIA and other chip makers on 2030 thermal roadmaps, building flexibility into the designs so a single new CDU can handle what previously required two units. The Q1 to Q2 2026 production ramp on these platforms is already underway with strong customer reception.

For distributors handling nVent enclosures, cable management, and cooling products, this is a product development pace that demands attention. Staying current on what is available and what is coming is not optional if you want to be relevant in conversations with contractors and end users working on data center and infrastructure projects.

Segment Detail

Systems Protection posted Q4 sales of $737 million, up 58% and 34% organic. Segment income was up 49% to $149 million, though return on sales was 20.3%, down 120 basis points year-over-year due to inflation and growth investments. The Americas were up 45%, led by data center demand. This segment is the primary beneficiary of the infrastructure wave.

Electrical Connections posted Q4 sales of $330 million, up 15% and 8% organic. Segment income was up 8% to $91 million, with return on sales at 27.6%, down 180 basis points, mainly from inflation. Infrastructure was up roughly 25%, industrial mid-single digits, commercial/residential low single digits. EPG added 6 points to the segment’s growth.

Both segments felt margin pressure. Inflation hit nearly $55 million in Q4, with more than $40 million of that coming from tariffs alone. Management says price plus productivity offset inflation, but mix shift toward lower-margin infrastructure work, growth investments, and higher incentive compensation kept return on sales below internal targets. That margin story is worth watching in 2026.

The Tariff Question

nVent has explicitly budgeted $80 million in incremental tariff costs for 2026, weighted to the first half. That is on top of the $40-million-plus tariff hit they absorbed in Q4 2025. Management says price and productivity will offset it. Shareholders on the call pushed hard on whether that math holds if duties escalate further.

For distributors, this is a pricing conversation that is coming, if it has not already. When a manufacturer budgets $80 million in tariff costs and says they will cover it with price and productivity, part of that price piece lands in the channel. Understanding what is in the pipeline and what pricing adjustments are coming is a conversation worth having with your nVent contacts sooner rather than later.

What the Backlog Tells You

Year-end backlog was $2.3 billion, roughly triple the prior year. Organic orders in Q4 grew approximately 30%. Shareholders asked the obvious question: is this multi-year secular demand or a near-term hyperscaler capex peak?

CEO Beth Wozniak pointed to broad-based acceleration across data centers, utilities, and industrial rather than concentration in a handful of hyperscaler contracts. The 86 new products adding 10 points to sales growth and the nVent portfolio transformation positioning infrastructure at 45% of revenue support the argument that this is structural rather than cyclical. But the honest answer is that nobody knows with certainty how long data center capex sustains at these levels. What the backlog does tell you with certainty is that nVent has visibility into demand that stretches well into 2026 and likely beyond.

nVent’s Investor Day is scheduled for February 24, 2026. That is where the company is expected to lay out its longer-term strategic roadmap. For reps and distributors, anything announced there around go-to-market priorities, vertical focus, or product line direction is worth paying close attention to.

What the nVent Portfolio Transformation Means for the Channel

nVent has made its bet. Infrastructure, data centers, utilities, and an aggressive new product cadence in liquid cooling and power management. The company has reshaped its portfolio, loaded its backlog, and told the market exactly where it is going.

The question is whether the channel is keeping pace. If you are a distributor still allocating shelf space and sales attention to nVent the same way you did in 2022, you are mismatched with where the manufacturer is investing and where the margin opportunity is concentrating. If you are a rep firm, the mix of technical knowledge and project-level selling that infrastructure and data center work demands is different from traditional commercial and industrial coverage.

None of this means walking away from the verticals that still generate steady business. It means recognizing that nVent’s growth, new product investment, and strategic attention have a clear direction. Aligning with that direction is not about chasing a trend. It is about staying relevant to a manufacturer that has fundamentally changed what it is.

If this aligns with what you are seeing in your market, I would like to compare notes. CMG works with manufacturers, distributors, and rep firms who want clearer strategy, stronger channel performance, and better alignment across the field. If you are exploring ways to strengthen your commercial approach, reach out and let’s talk through what you are trying to build.

Leave a Reply